Analog Devices, Inc. (ADI)

Executive Summary

ADI has the potential to deliver exceptional returns if it can capitalize on favorable market trends and execute its growth strategy effectively.

Investment Thesis

The Bull Case

ADI has the potential to deliver exceptional returns if it can capitalize on favorable market trends and execute its growth strategy effectively.

Catalysts:

- Faster than expected growth in key markets such as industrial automation and automotive electrification.

- Successful development and launch of new products.

- Strategic acquisitions that expand ADI's product portfolio and market reach.

The Bear Case (Risks)

A severe economic downturn or significant loss of market share could negatively impact ADI's financial performance and stock price.

Risks:

- Economic recession

- Increased competition

- Technological obsolescence

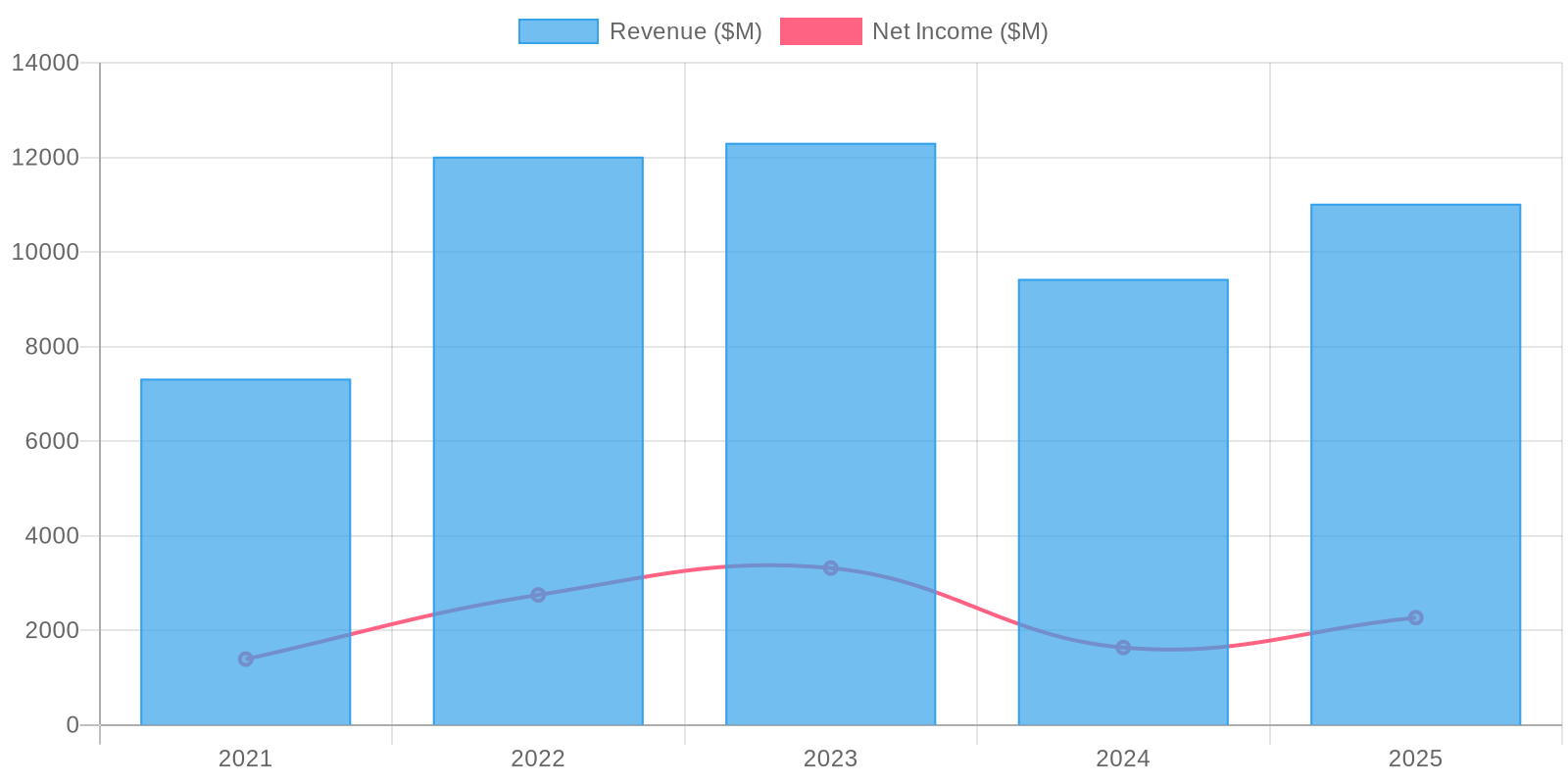

📊 The Numbers

Revenue & Growth

Revenue has grown at a CAGR of 0.5% over the last period.

Valuation

Fair Value Estimate: $246.01 (Upside: 10%) Methodology: Price to Sales