ASE Technology Holding Co., Ltd. (ASX)

Executive Summary

Continued strong growth in the semiconductor market, coupled with ASE's leadership in advanced packaging technologies, could drive significant revenue and earnings growth, leading to substantial shareholder returns.

Investment Thesis

The Bull Case

Continued strong growth in the semiconductor market, coupled with ASE's leadership in advanced packaging technologies, could drive significant revenue and earnings growth, leading to substantial shareholder returns.

Catalysts:

- Faster-than-expected adoption of advanced packaging technologies.

- Increased outsourcing of packaging and testing services by IDMs.

- Successful integration of acquisitions and strategic partnerships.

The Bear Case (Risks)

A significant downturn in the semiconductor market, coupled with increased competition and a failure to adapt to new technologies, could lead to a substantial decline in ASE's revenue and profitability.

Risks:

- Increased competition

- Economic downturn

- Technological obsolescence

📊 The Numbers

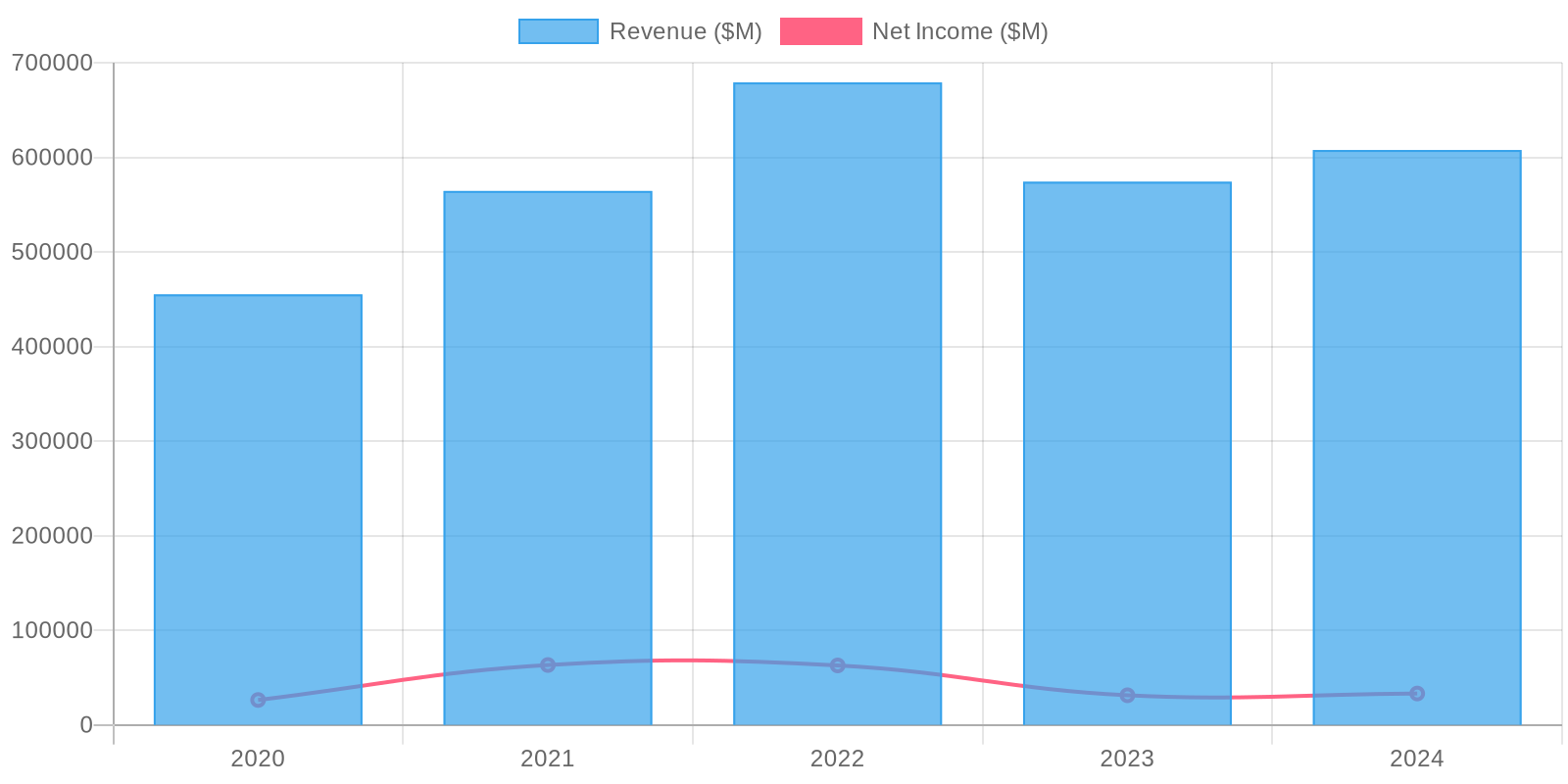

Revenue & Growth

Revenue has grown at a CAGR of 0.3% over the last period.

Valuation

$15.36 (Upside: 0%) Price-to-Sales Ratio