Marvell Technology, Inc. (MRVL)

Executive Summary

If Marvell successfully capitalizes on key growth drivers, its stock price could see substantial upside.

Investment Thesis

The Bull Case

If Marvell successfully capitalizes on key growth drivers, its stock price could see substantial upside.

Catalysts:

- Accelerated growth in data center spending.

- Wider adoption of 5G technology.

- Successful integration of acquisitions.

The Bear Case (Risks)

A significant economic downturn or loss of key customers could negatively impact Marvell's revenue and profitability.

Risks:

- Customer Concentration

- Product Concentration

- Geographic Concentration

- Intense competition

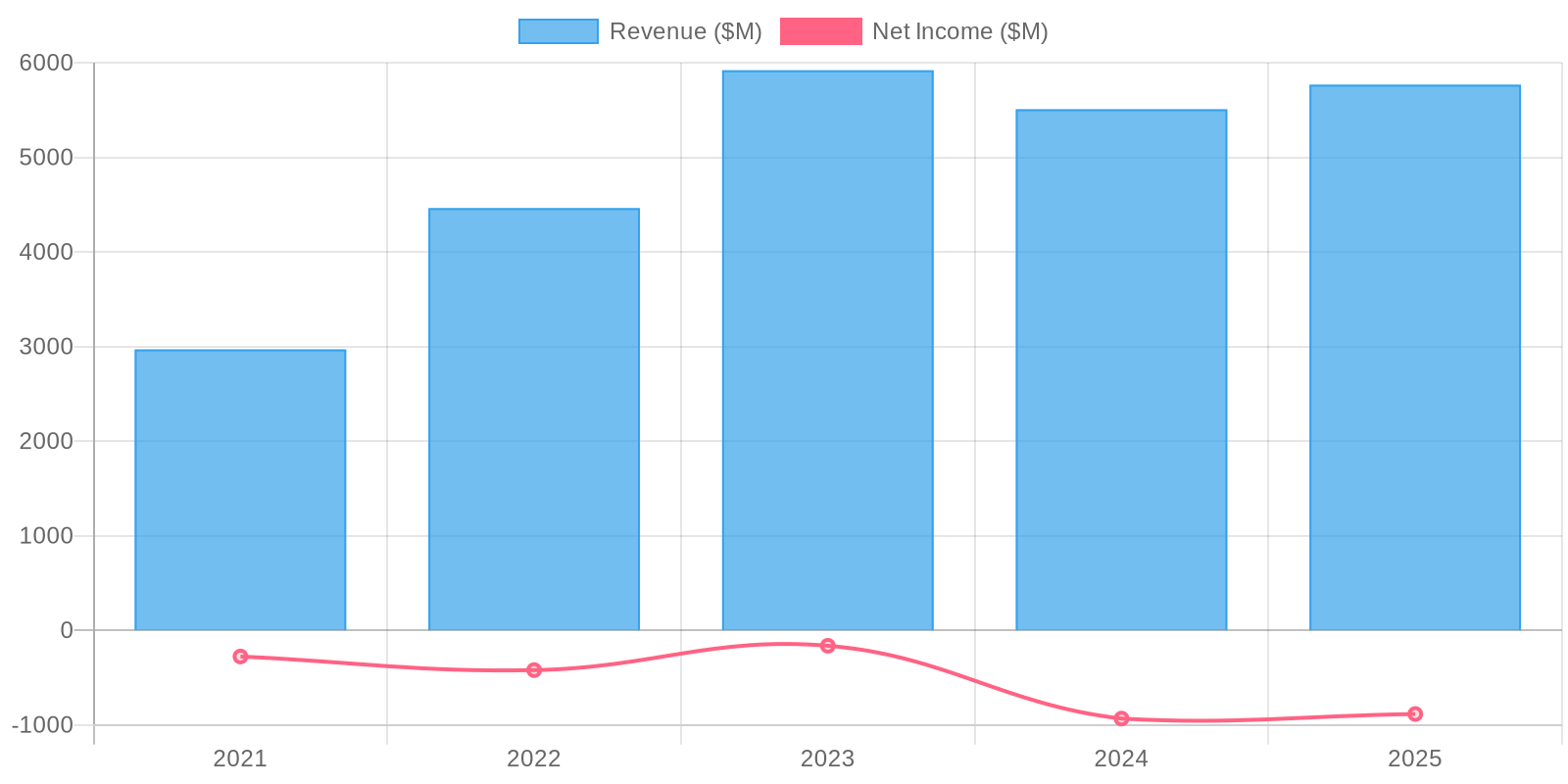

📊 The Numbers

Revenue & Growth

Revenue has grown at a CAGR of 0.9% over the last period.

Valuation

Fair Value Estimate: $75 (Upside: 11%) Methodology: Price/Sales

Marvell's valuation is sensitive to revenue growth and margin assumptions. A slowdown in growth or a decline in margins could negatively impact the stock price.