Nokia Oyj (NOK)

Executive Summary

Nokia's strong position in the 5G market, coupled with its focus on innovation and cost efficiency, could drive significant revenue and profit growth, leading to substantial returns for investors.

Investment Thesis

The Bull Case

Nokia's strong position in the 5G market, coupled with its focus on innovation and cost efficiency, could drive significant revenue and profit growth, leading to substantial returns for investors.

Catalysts:

- Faster-than-expected 5G adoption.

- Successful development and commercialization of new technologies.

- Market share gains from competitors.

- Strategic acquisitions or partnerships.

The Bear Case (Risks)

If Nokia fails to innovate and compete effectively, it could face significant revenue declines and margin compression, leading to substantial losses for investors.

Risks:

- Increased competition

- Technological advancements rendering current products obsolete.

- Economic downturn impacting telecom spending.

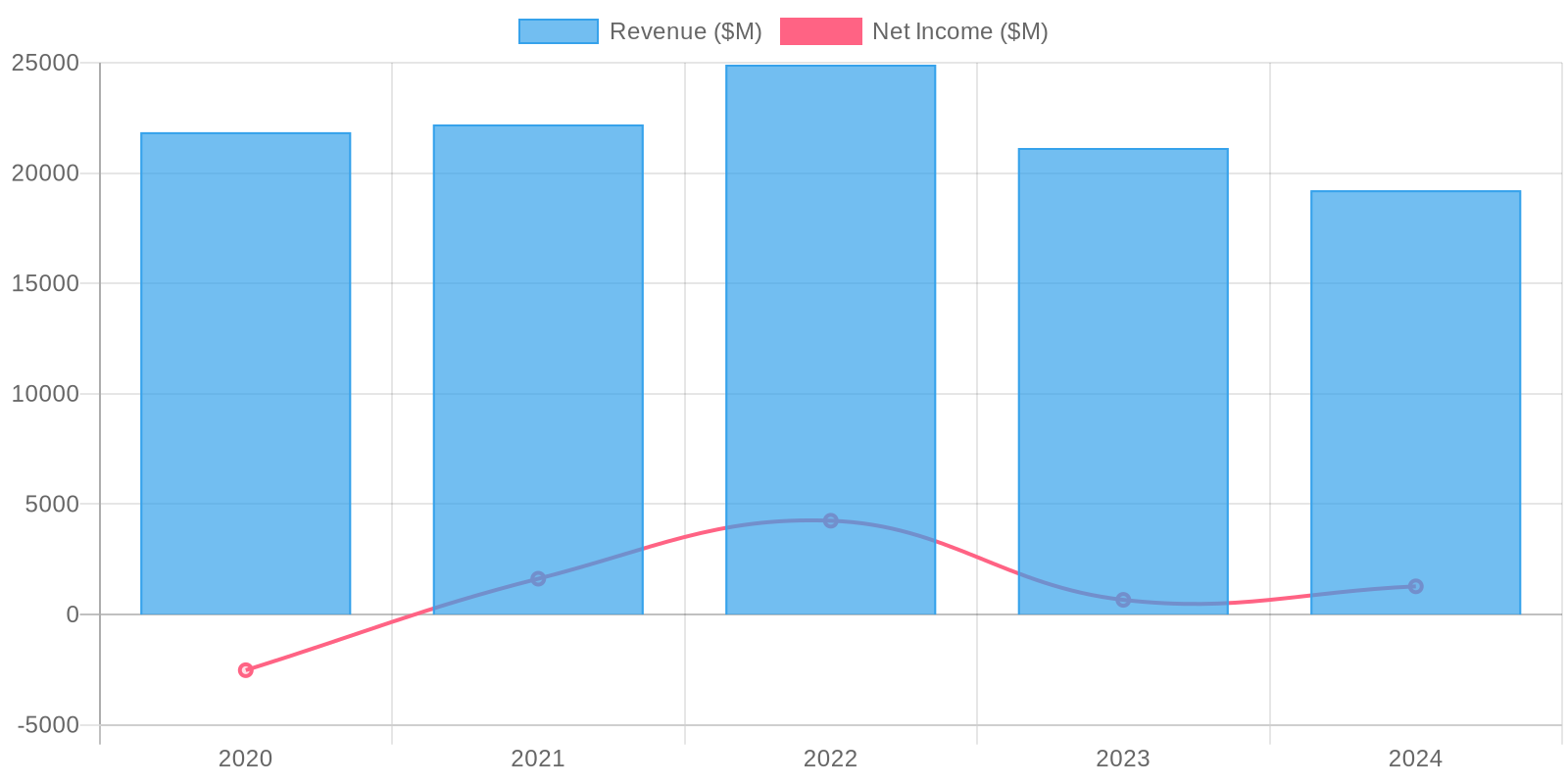

📊 The Numbers

Revenue & Growth

Revenue has grown at a CAGR of -0.1% over the last period.

Valuation

$6.1 (Upside: 0.05%) Discounted Cash Flow (DCF)