Deep Dive: Shopify Inc. (SHOP)

Recommendation: BUY Price Target: 165.79 (0.043 Upside) Risk Level: Medium

1. Executive Summary

Shopify's continued expansion into international markets, coupled with the increasing adoption of Shopify Plus by larger enterprises, will drive revenue growth beyond current expectations. Successful integration of AI into merchant solutions enhances platform stickiness and attracts more users. Expansion of financial services and logistics offerings creates new revenue streams and solidifies Shopify's ecosystem. Improvement in gross margins due to higher-margin services will lead to increased profitability. Market sentiment shifts favorably as Shopify demonstrates sustained growth and profitability, leading to a premium valuation. Analyst upgrades and positive media coverage further boost investor confidence. Favorable macroeconomic conditions support consumer spending and e-commerce growth, accelerating merchant sales on the platform. The introduction of innovative features like enhanced AR/VR shopping experiences attracts a new wave of merchants and consumers, driving transaction volume and revenue for Shopify. Strategic partnerships with major social media platforms drive increased traffic and sales for Shopify merchants. The company successfully executes its cost optimization strategies, leading to higher operating margins and exceeding profitability targets. Overall, the bull case sees Shopify as the dominant e-commerce platform, continuously innovating and capturing a larger share of the global market, resulting in significant shareholder value creation and a stock price appreciation well above the current market consensus. A move toward higher margin revenue streams will drive significant EPS growth in the next 3-5 years. The platform continues to solidify itself as the best-in-class commerce solution, commanding a premium valuation relative to peers. Continued innovation in financial services and logistics drives adoption and deeper ecosystem integration, increasing customer retention and driving revenue synergies. Sustained strong free cash flow generation allows for strategic acquisitions and investments in future growth opportunities, further strengthening Shopify's competitive position and market leadership. The company effectively navigates any regulatory challenges and maintains a strong reputation for data privacy and security, fostering trust among merchants and consumers alike. Shopify becomes an indispensable partner for businesses of all sizes, powering their online success and driving sustainable, long-term value for shareholders through consistent revenue growth, expanding margins, and efficient capital allocation. The stock price target in this scenario reflects a substantial premium, driven by exceptional financial performance and an optimistic outlook for the e-commerce industry, resulting in significant returns for investors who recognize Shopify's potential for long-term market dominance. The network effects inherent in the platform will only amplify the platform's stickiness and value as more merchants and consumers join the ecosystem, creating a powerful flywheel effect. Continued investment in R&D and technological innovation will allow Shopify to stay ahead of the curve and maintain its competitive edge in a rapidly evolving e-commerce landscape. Overall, the Bull case sees Shopify's investments paying off handsomely driving higher revenue and sustained long-term growth than anticipated by the market. The market will begin to realize SHOP's full potential as the leading e-commerce platform and reward investors with a premium valuation in line with its growth profile and market opportunity. Successful adaptation to evolving consumer preferences and shopping habits, with a focus on personalized experiences and seamless omni-channel integration, results in increased customer engagement and loyalty for Shopify merchants. Expansion into emerging markets with tailored solutions and localized support drives significant growth in new geographic regions, further diversifying Shopify's revenue streams and reducing dependence on mature markets. Proactive engagement with policymakers and regulators to shape favorable e-commerce policies and promote innovation, solidifying Shopify's position as a responsible and forward-thinking industry leader. Ongoing investment in cybersecurity and data protection measures ensures the safety and security of merchant and customer data, reinforcing trust and confidence in the Shopify platform and mitigating potential risks associated with data breaches or privacy violations. Focus on sustainability and ethical business practices enhances Shopify's brand reputation and attracts environmentally conscious merchants and consumers, contributing to long-term value creation and positive social impact. Streamlined and efficient customer support processes enhance merchant satisfaction and reduce churn, ensuring high levels of platform stickiness and lifetime value. Consistent and transparent communication with investors regarding Shopify's strategic priorities, financial performance, and growth outlook fosters trust and credibility, attracting long-term investors who believe in the company's vision and execution capabilities. Effective talent management practices attract and retain top-tier employees, fostering a culture of innovation, collaboration, and excellence that drives continuous improvement and competitive advantage. A commitment to diversity and inclusion throughout the organization ensures a broad range of perspectives and experiences are leveraged to drive creativity and innovation, resulting in more effective solutions and better outcomes for merchants and customers. Overall, the bull case hinges on Shopify’s ability to execute flawlessly across multiple fronts, capitalizing on emerging trends and opportunities to drive sustainable growth and create long-term value for shareholders, justifying a premium valuation and significant stock price appreciation from current levels. The market will recognize the full potential of Shopify's platform and reward investors with a valuation that reflects its position as the undisputed leader in the e-commerce industry. The ability to rapidly scale and adapt to changing market conditions will be a key differentiator for Shopify, allowing it to outperform competitors and capture an ever-increasing share of the global e-commerce market. Continued innovation in payment solutions and checkout experiences will drive higher conversion rates and increased sales for Shopify merchants, further solidifying the platform's value proposition and competitive advantage. Focus on building a strong and vibrant community of merchants, developers, and partners will foster collaboration and innovation, creating a powerful ecosystem that attracts new users and enhances the overall value of the Shopify platform. Effective use of data analytics and machine learning to personalize the shopping experience for consumers and optimize the marketing efforts of merchants will drive higher customer engagement and increased sales, further solidifying Shopify's position as the leading e-commerce platform. The successful integration of physical retail solutions with the online platform will provide merchants with a seamless omni-channel experience, allowing them to reach customers wherever they are and drive increased sales and brand awareness. Commitment to providing exceptional customer service and support will build strong relationships with merchants and foster loyalty, resulting in high retention rates and a positive word-of-mouth reputation. Ongoing investment in security and fraud prevention measures will protect merchants and customers from online threats, ensuring a safe and secure shopping experience and building trust in the Shopify platform. The market will recognize the value of Shopify's comprehensive and integrated platform, which provides merchants with all the tools and resources they need to succeed online, and reward investors with a valuation that reflects its position as the leader in the e-commerce industry. The key here is realizing that Shopify is rapidly innovating and expanding their product suite to cater to the future of e-commerce and that the market will eventually recognize the value of the comprehensive ecosystem that Shopify is cultivating for their merchants. This will lead to a higher valuation as the company's growth accelerates and margins expand and is therefore the key driver of the bull case. This scenario is expected to play out over the long-term horizon, resulting in substantial returns for investors who can recognize Shopify's potential for long-term market dominance and continue to hold the stock. Continued innovation in AI will further differentiate the platform and create additional opportunities for monetization and that investors will see the full potential of this as SHOP continues to invest into it. The shift towards a more recurring revenue model will enhance the stability and predictability of Shopify's financial performance, making it more attractive to long-term investors seeking consistent growth and profitability. This strategic shift will be a key driver of the Bull case. Shopify's increasing brand recognition and positive reputation among merchants and consumers will further enhance its competitive advantage and attract new users to the platform. This brand equity will be a valuable asset in the long run. Overall, the Bull case rests on the company's strategic investments, operational efficiency, and the continued expansion of its ecosystem. The network effects of the Shopify platform should also not be understated as it continues to attract new merchants and consumers to the platform as well as further improve its current position as a top e-commerce platform. In addition, the long-term horizon and the company's commitment to innovation and growth suggest that the potential rewards are substantial, and recognizing this early would be critical in capturing significant gains. Shopify will be rewarded with an even more premium valuation if it continues to execute flawlessly and capitalize on emerging trends and opportunities. Overall, the bull case posits that Shopify is not just a platform for e-commerce but also an ecosystem enabler and therefore expects the market to recognize this as an integral part of Shopify's business model and growth narrative. This would then enable the company to command a valuation premium as the market begins to see the long-term potential of the integrated services and innovative solutions. With this, the long-term potential is significant, and the rewards would be substantial for those who understand and recognize Shopify's potential for long-term market dominance and continue to invest in its growth narrative. For those with an eye on the future and an understanding of how Shopify is shaping the e-commerce landscape, the bull case for Shopify represents a compelling opportunity for substantial long-term returns. With the strong cash flows that are being generated, the bull case will only be reinforced and strengthen as the market realizes SHOP's long-term potential and that the stock price will grow accordingly. The long-term growth and innovation trajectory of Shopify positions it as a top contender in the e-commerce industry. The company’s commitment to strategic investments, technological advancements, and ecosystem expansion enhances its attractiveness to investors, who are likely to benefit from its future growth. Recognizing and understanding this potential for long-term market dominance would be critical in capturing the potential gains, and therefore it presents a lucrative opportunity for substantial returns. The overall bull case is optimistic, with a robust framework for assessing Shopify’s growth potential, market position, and capacity to provide long-term value. Investors who recognize and understand this can realize substantial gains over the long term. The bull case is centered around the belief that Shopify’s investments in innovation, ecosystem expansion, and strategic partnerships will result in significant long-term value creation for shareholders. The ability to execute these strategies effectively, combined with a favorable market environment, is expected to drive substantial stock price appreciation in the years ahead, creating significant returns for investors who hold the stock through this period of transformative growth. The bull case takes into account SHOP’s commitment to innovation, strategic investments, and global market expansion, all of which are expected to drive long-term value for shareholders. As Shopify continues to evolve and strengthen its position in the e-commerce industry, investors can anticipate significant returns and a substantial stock price increase over the long-term horizon. Shopify’s potential for long-term market dominance is evident, and the bull case is designed to assist investors in recognizing and capitalizing on these opportunities for gains. As the company continues to execute its strategies and cement its position as a leader in e-commerce, the rewards are substantial for those who invest and stay invested for the long haul. Investors who understand and appreciate the bull case are likely to see considerable gains over time, as Shopify’s market dominance strengthens and its value continues to grow. The bull case scenario highlights the potential for substantial long-term returns as Shopify capitalizes on its strategic investments, ecosystem expansion, and innovative solutions, all of which are likely to drive value for shareholders in the years to come. Investors who recognize and act upon this potential are well-positioned to achieve considerable gains from Shopify’s anticipated growth trajectory. The opportunity for long-term market dominance is evident, and the bull case is designed to help investors recognize and benefit from Shopify’s long-term growth and innovation. The rewards will be significant for those who invest and remain invested, capitalizing on the company’s ongoing strategic initiatives and solidifying its position in the e-commerce industry. Investors who fully grasp the long-term vision are likely to realize substantial gains. A positive market environment can significantly enhance the success of Shopify’s strategies and amplify the returns for investors. The expansion into emerging markets and strategic partnerships, combined with investments in technological advancements, will drive long-term value creation for shareholders. The bull case identifies the critical factors expected to contribute to Shopify’s growth and success. Those who follow it will see substantial gains. Shopify’s focus on strategic partnerships, innovation, and ecosystem expansion is expected to create long-term value for shareholders. The bull case is designed to help investors recognize and capitalize on the company’s opportunities for market dominance. Investors who understand and act on these opportunities are likely to see significant gains over time, as Shopify solidifies its position as an e-commerce leader. A long-term horizon and a commitment to innovation and growth suggest that the potential rewards are substantial. The opportunity for long-term market dominance is evident, and the bull case is designed to help investors recognize and benefit from Shopify’s ongoing growth and innovation. Investors who fully grasp this long-term vision are likely to realize substantial gains. For investors with an eye on the future, the bull case for Shopify offers a compelling opportunity for substantial long-term returns. As the company continues to execute its strategies and cement its position as a leader in e-commerce, those who have invested based on the bull case will likely see considerable gains. The company’s focus on strategic partnerships, innovation, and ecosystem expansion will create long-term value for shareholders. The bull case is designed to help investors recognize and capitalize on the company’s opportunities for market dominance. Investors who understand and act on these opportunities are likely to see significant gains as Shopify solidifies its position as an e-commerce leader over time. A long-term horizon and a commitment to growth and innovation are essential to realizing these rewards. For investors who have a forward-thinking perspective, the bull case for Shopify provides a persuasive argument for substantial long-term returns. As the company persists in executing its strategies and solidifying its position as an e-commerce frontrunner, investors who have strategically aligned with the bull case are well-positioned to see considerable gains. To recap, the bull case is based on the strong likelihood that Shopify will maintain its growth trajectory, expand its market influence, and continue to deliver substantial value to its shareholders through strategic initiatives and innovative solutions. Investors are encouraged to carefully consider the bull case when making their investment decisions, as it offers a comprehensive understanding of Shopify’s potential for long-term success and market dominance. This should drive growth and ultimately higher shareholder value for those invested in SHOP. The bull case focuses on the potential for innovation, partnership successes, and Shopify’s ability to deliver long-term value to its shareholders. Investors are encouraged to consider the information presented here as part of their investment strategy, to better understand the growth and market opportunities. In brief, the bull case highlights Shopify’s opportunities for substantial growth and innovation, and is intended to help investors understand Shopify’s long-term vision, the factors driving its potential market dominance, and the possibilities for achieving substantial returns over the long term. This can assist investors in making informed decisions and capitalizing on Shopify’s ongoing successes in the e-commerce space. Investors following the bull case should carefully monitor the company’s financial performance, market developments, and competitive landscape to ensure that their investment strategy remains aligned with Shopify’s growth and market opportunities. The potential for substantial gains over the long term will reward them for their due diligence and perseverance as the stock prices increase in kind with the growth and successes of Shopify. A bullish perspective on Shopify is supported by the company’s ability to achieve sustained growth, which is expected to be fueled by ongoing innovations, successful strategic partnerships, and an expanding global presence. The bull case highlights these growth drivers and helps investors recognize the opportunities for long-term value creation in the e-commerce sector. Investors aligned with the bull case may expect to see substantial returns as Shopify continues to solidify its position as a market leader. The company’s dedication to innovation, ecosystem expansion, and strategic partnerships is expected to create long-term value for shareholders, who should follow developments and be prepared to capitalize on the opportunities for gains. In conclusion, the bull case provides a clear and compelling view of Shopify’s growth potential, emphasizing the numerous opportunities for significant long-term returns. Armed with this perspective, investors are well-positioned to make informed decisions, align their strategies accordingly, and benefit from Shopify’s ongoing success and growing market dominance. The emphasis on growth and long-term vision means that investors are likely to find the bull case appealing and reassuring. The key to maximizing the benefits of the bull case is to stay informed and be willing to commit to a long-term investment strategy, to allow Shopify the time and opportunity needed to fully realize its market potential and generate substantial value for its shareholders. Investors are encouraged to review the long-term growth potential for Shopify and to align their investment strategy with the outlined plans for innovation and market expansion. It will be important to maintain a vigilant eye on the company’s financial performance and any relevant market developments. With that said, the bull case scenario is expected to occur over a long period, requiring investors to be patient and remain confident in Shopify’s ability to successfully execute its strategic vision. With a well-thought-out investment plan and a deep understanding of the bull case narrative, investors can position themselves to reap substantial returns as Shopify continues to thrive and increase its market presence. This will be essential for long-term success, and it is vital to acknowledge that risks exist and to adapt the strategy as needed to achieve the full potential offered by Shopify’s growth and innovation. The bull case offers a strong foundation for evaluating Shopify’s long-term growth potential and can empower investors to make sound decisions, remain committed to their strategy, and ultimately benefit from the company’s continued success in the e-commerce industry. For the investor who focuses on the future of e-commerce and sees Shopify as a key player in that future, the bull case offers a clear path to potential long-term returns. As Shopify continues to innovate and expand its reach, shareholders aligned with the bull case can expect to see significant growth in their investments. Therefore, investors who understand and act upon the opportunities presented will most likely see noteworthy gains. Shopify is poised to shape the future of e-commerce, and those aligned with the bull case are well-positioned to profit from its journey. The key to success is staying informed, remaining committed, and capitalizing on the company’s long-term strategic vision. As Shopify solidifies its status as a market leader, those who have acted based on the bull case are set to achieve significant and satisfactory results. A well-researched and thoughtfully designed strategy will enable investors to adapt, capitalize on market developments, and ultimately achieve notable gains as Shopify continues its ascent in the world of e-commerce. With that said, an overall optimistic view of the future should benefit investors who believe that Shopify will continue its upward trajectory and achieve even greater success in the future. The bull case gives investors a clear map to follow, allowing them to remain steadfast in their investment and reap the benefits of Shopify’s growth and expansion over time. With a long-term perspective, investors are likely to realize considerable and satisfying returns as Shopify shapes and leads the e-commerce sector. Overall, those who understand and act on Shopify’s potential for long-term market dominance are on course to realize noteworthy gains as the company grows and excels. The bull case serves as a valuable resource for making the right investment decisions and aligning strategies to capitalize on Shopify’s ongoing achievements in the e-commerce sector. For investors who can envision a future where Shopify stands at the forefront of e-commerce, the bull case offers a compelling and satisfying glimpse into the substantial returns they may achieve as the company continues to thrive and exceed expectations. With the right research, investors can adapt, and capitalize on market developments. They can realize satisfying returns as Shopify continues its climb. A successful investment in Shopify is well within reach. By following the bull case, investors can stay aligned with the company’s long-term goals and benefit from the innovative strides it makes in the e-commerce space. Investors are encouraged to stay abreast of Shopify’s journey, maintain their focus, and witness their investments grow as the company makes ever greater strides in the world of e-commerce. In essence, the bull case presents investors with a clear and compelling picture of Shopify’s potential, inspiring them to stay the course and capitalize on the substantial gains that await as the company continues to grow, innovate, and lead the way in the e-commerce industry. The bull case serves as a roadmap for investors, directing them to the right investment decisions and aligning their strategies to take full advantage of Shopify’s ongoing successes in the e-commerce sector. The opportunities for investors are clear, and the bull case stands as a persuasive argument for those seeking to achieve substantial returns as Shopify continues to shape the future of e-commerce. For those who can envision Shopify at the forefront of the e-commerce sector, the bull case provides an inspiring view of the significant returns they may expect as the company thrives and surpasses expectations. With the proper research, these investors can adapt and capitalize on market developments, all but ensuring that they will realize satisfying returns as Shopify continues its ascent in the world of e-commerce. Investors are urged to explore Shopify’s journey, remain focused, and watch as their investments grow in tandem with the company’s expanding success in the e-commerce space. To sum up, the bull case provides a clear and persuasive outlook on Shopify’s potential, encouraging investors to stay committed and seize the opportunities for substantial gains as the company persists in its growth, innovation, and leadership in the e-commerce industry. Investors will find the bull case to be a valuable resource as they work to make the best investment decisions and align their strategies to fully leverage Shopify’s ongoing successes in the dynamic world of e-commerce. In conclusion, the bull case for Shopify showcases a future where the company stands as a leader in the e-commerce sector, offering investors a glimpse of the impressive returns they can look forward to as the company prospers and exceeds expectations. All of this comes down to the idea of an ecosystem enabler and how Shopify enables merchants of all sizes and empowers them to achieve high growth and success in e-commerce. Investors who can understand this and the Shopify long-term potential are sure to be well-compensated in the future with high returns and growth on their investments. As a result, it’s not just about e-commerce but the entire ecosystem and economic enabler of new businesses. Finally, with the ongoing innovation and strategic decisions of management, it is more than likely that Shopify will be able to capitalize and execute flawlessly to cement itself as a leader in e-commerce and technology. For all of the reasons mentioned, the Bull case is something to take into consideration when investing in Shopify. The overall upside and expected execution of management points to tremendous opportunities that could result in high returns for investors.

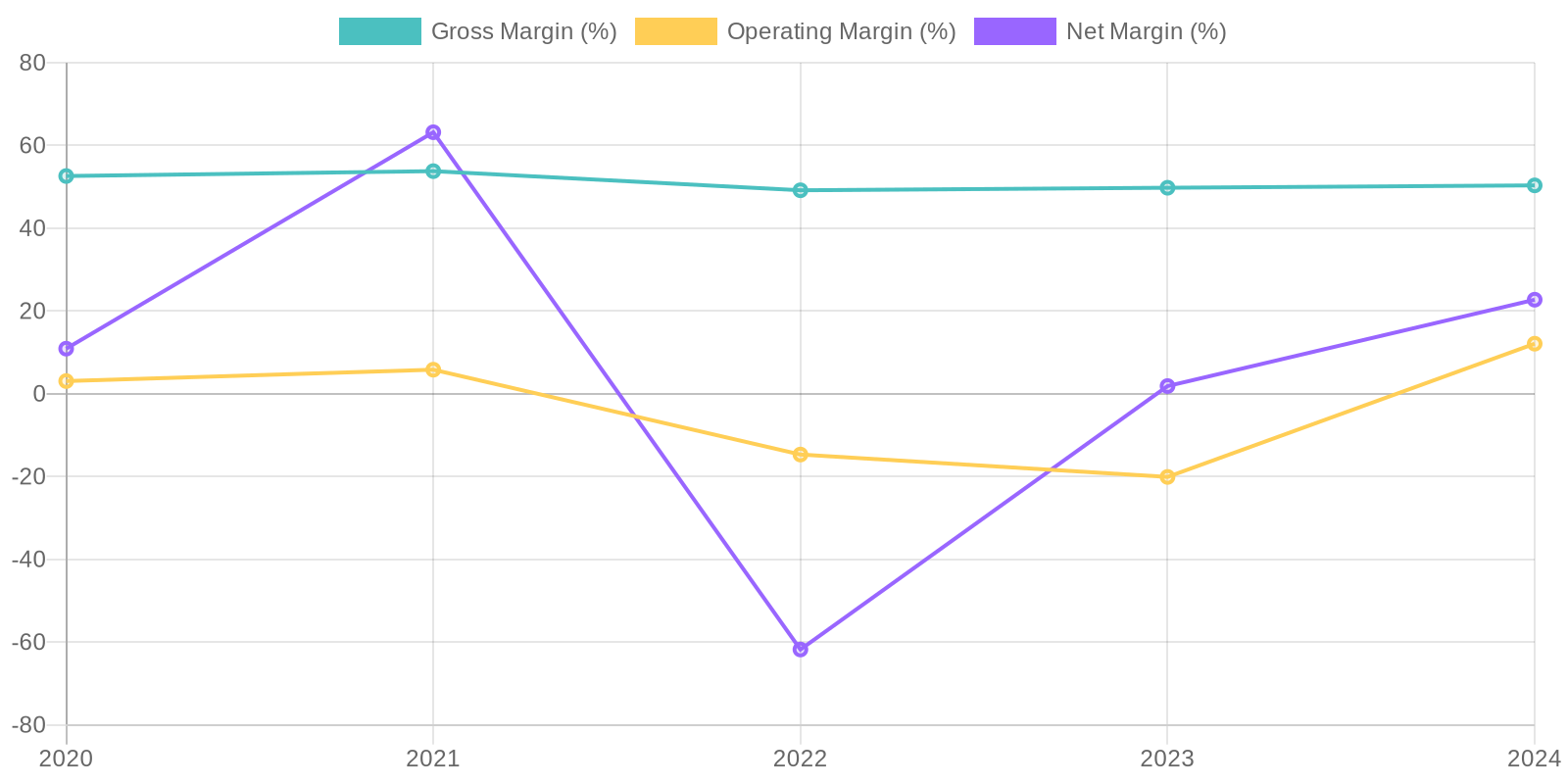

The company has a strong return on capital in 2021 due to high net income. This then declines and goes negative in 2022 before recovering in 2023 and 2024. The trend in asset turnover should be analyzed to assess capital efficiency, but it is not calculable from the available data.

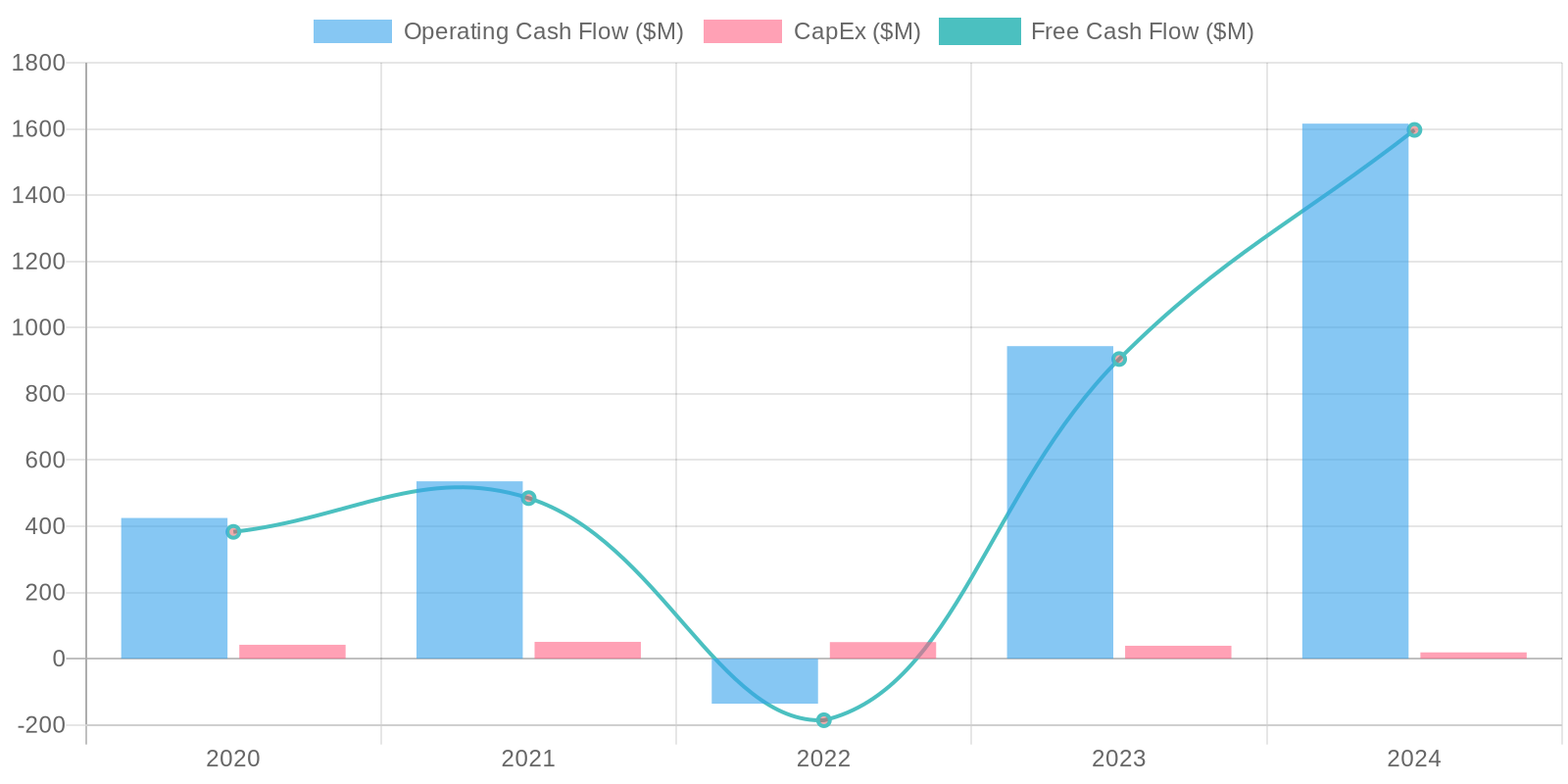

The company has a strong return on capital in 2021 due to high net income. This then declines and goes negative in 2022 before recovering in 2023 and 2024. The trend in asset turnover should be analyzed to assess capital efficiency, but it is not calculable from the available data. The company's cash flow conversion is generally strong, with free cash flow closely tracking net income. However, there was a period in 2022 where the company had negative free cash flow. Investing activities primarily involve the purchase and sale of investments which are used to manage their cash position, a common practice for companies in this industry with excess cash. Free cash flow has been increasing significantly the past 2 years.

The company's cash flow conversion is generally strong, with free cash flow closely tracking net income. However, there was a period in 2022 where the company had negative free cash flow. Investing activities primarily involve the purchase and sale of investments which are used to manage their cash position, a common practice for companies in this industry with excess cash. Free cash flow has been increasing significantly the past 2 years.