Sony Group Corporation (SONY)

Executive Summary

Sony's growth trajectory could be accelerated by successful product launches in its gaming division, strategic acquisitions in the entertainment industry, and breakthroughs in image sensor technology. These events could lead to increased revenue and profitability, driving significant stock appreciation.

Investment Thesis

The Bull Case

Sony's growth trajectory could be accelerated by successful product launches in its gaming division, strategic acquisitions in the entertainment industry, and breakthroughs in image sensor technology. These events could lead to increased revenue and profitability, driving significant stock appreciation.

Catalysts:

- Successful launch of new gaming consoles or related services.

- Acquisition of a major entertainment studio or music label.

- Breakthrough innovation in image sensor technology.

The Bear Case (Risks)

Economic downturns could significantly reduce consumer spending, impacting Sony's electronics and entertainment segments. Increased competition from companies like Microsoft and Netflix, and unfavorable exchange rates could further negatively impact Sony's financial performance.

Risks:

- Economic recession.

- Technological obsolescence.

- Unsuccessful product launches.

📊 The Numbers

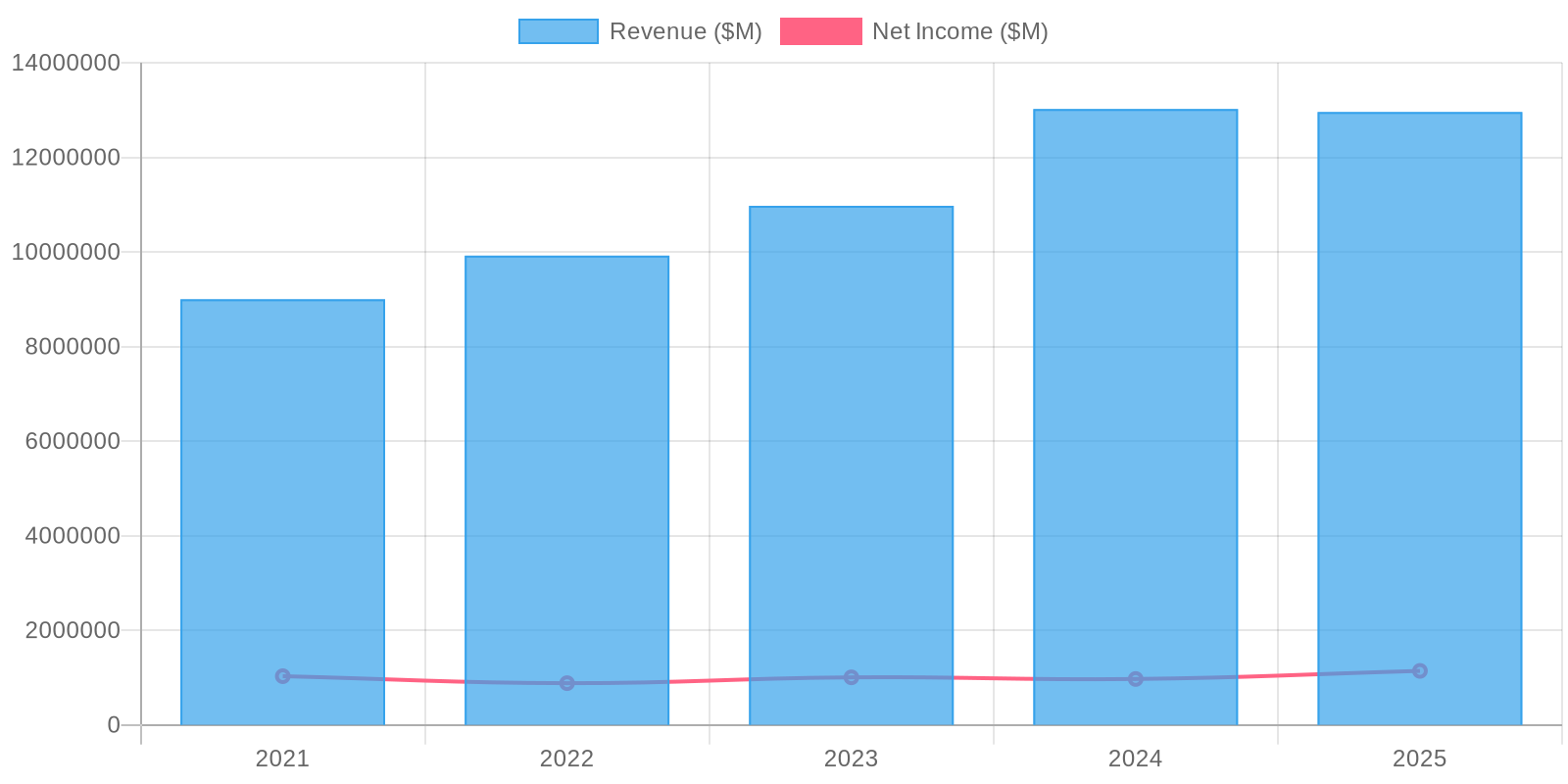

Revenue & Growth

Revenue has grown at a CAGR of 0.4% over the last period.