Wipro Limited (WIT)

Executive Summary

Wipro has the potential to outperform if it can successfully capitalize on the growing demand for digital transformation services and improve its profitability. Cost optimization and new market entry could also boost growth.

Investment Thesis

The Bull Case

Wipro has the potential to outperform if it can successfully capitalize on the growing demand for digital transformation services and improve its profitability. Cost optimization and new market entry could also boost growth.

Catalysts:

- Successful execution of digital transformation strategy.

- Acquisition of new clients and expansion into new markets.

- Improvement in profitability through cost optimization.

The Bear Case (Risks)

Wipro's performance may decline if it fails to adapt to market changes or faces adverse economic conditions. The increased debt also puts pressure on the company.

Risks:

- Industry competition

- Economic cycles

- Technological obsolescence

- Debt burden

📊 The Numbers

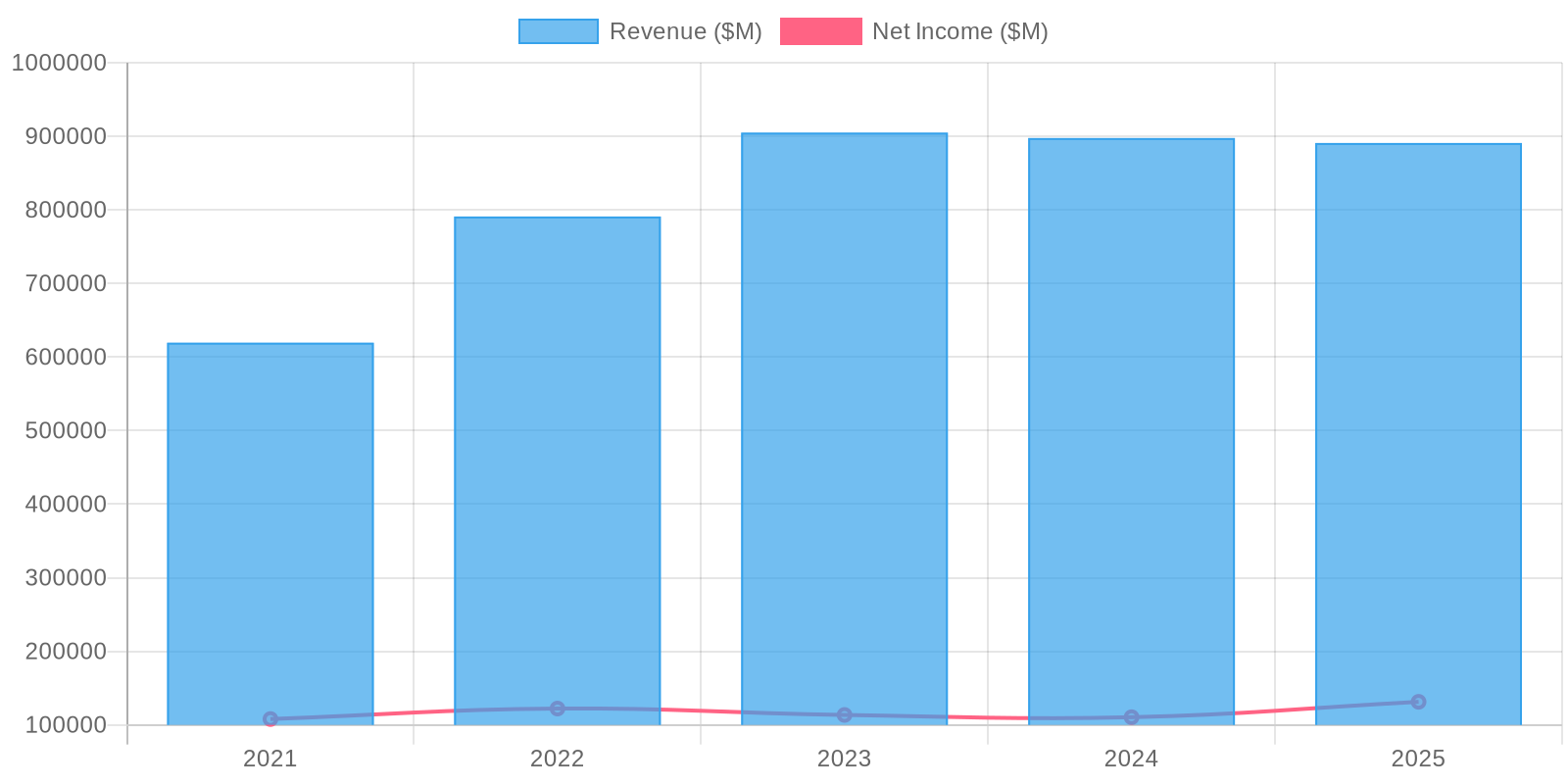

Revenue & Growth

Revenue has grown at a CAGR of 0.4% over the last period.

Valuation

$2.42 (Upside: 0%) Price/Sales Ratio