Recommendation: BUY Price Target: 267.5 (0.146 Upside) Risk Level: Medium

1. Executive Summary

Salesforce's dominant position in the CRM market, coupled with successful acquisitions and innovation, will drive accelerated revenue and earnings growth. Margin expansion initiatives will further enhance profitability, leading to significant shareholder value creation. The company's shift towards increased profitability and efficiency will be well received by the market.

Investment Thesis

Bull Case: Salesforce's dominant position in the CRM market, coupled with successful acquisitions and innovation, will drive accelerated revenue and earnings growth. Margin expansion initiatives will further enhance profitability, leading to significant shareholder value creation. The company's shift towards increased profitability and efficiency will be well received by the market. Bear Case: An economic slowdown could significantly impact IT spending, leading to slower growth in cloud CRM adoption. Integration challenges with acquired companies and increased competition could erode Salesforce's market share and pricing power, resulting in lower revenue growth and margin contraction. Increased debt and associated interest expense could further pressure earnings, leading to a decline in the stock price. Conviction: High

2. Business Overview

Salesforce, Inc. provides customer relationship management technology that brings companies and customers together worldwide. Its Customer 360 platform empowers its customers to work together to deliver connected experiences for their customers. The company's service offerings include Sales to store data, monitor leads and progress, forecast opportunities, gain insights through analytics and relationship intelligence, and deliver quotes, contracts, and invoices; and Service that enables companies to deliver trusted and highly personalized customer service and support at scale. Its service offerings also comprise flexible platform that enables companies of various sizes, locations, and industries to build business apps to bring them closer to their customers with drag-and-drop tools; online learning platform that allows anyone to learn in-demand Salesforce skills; and Slack, a system of engagement. In addition, the company's service offerings include Marketing offering that enables companies to plan, personalize, and optimize one-to-one customer marketing journeys; and Commerce offering, which empowers brands to unify the customer experience across mobile, web, social, and store commerce points. Further, its service offerings comprise Tableau, an end-to-end analytics solution serving various enterprise use cases; and MuleSoft, an integration offering that allows its customers to unlock data across their enterprise. The company provides its service offering for customers in financial services, healthcare and life sciences, manufacturing, and other industries. It also offers professional services; and in-person and online courses to certify its customers and partners on architecting, administering, deploying, and developing its service offerings. The company provides its services through direct sales; and consulting firms, systems integrators, and other partners. Salesforce, Inc. was incorporated in 1999 and is headquartered in San Francisco, California.

Competitive Moat (Wide)

Trend: Stable First-mover advantage in cloud CRM, Strong ecosystem of partners and developers, Culture of innovation

Key Strengths:

- First-mover advantage in cloud CRM

- Strong ecosystem of partners and developers

- Culture of innovation

Key Weaknesses: N/A

3. Industry Analysis

Sector: Technology | Industry: Software - Application Stage: Growth | TAM: N/A

Growth is driven by increasing demand for digital transformation, cloud adoption, and the need for businesses to enhance customer engagement and streamline operations. Specific growth rates vary depending on the source and segment, but generally, the application software market is expected to see healthy growth in the foreseeable future.

Regulatory Environment: N/A

4. Financial Analysis

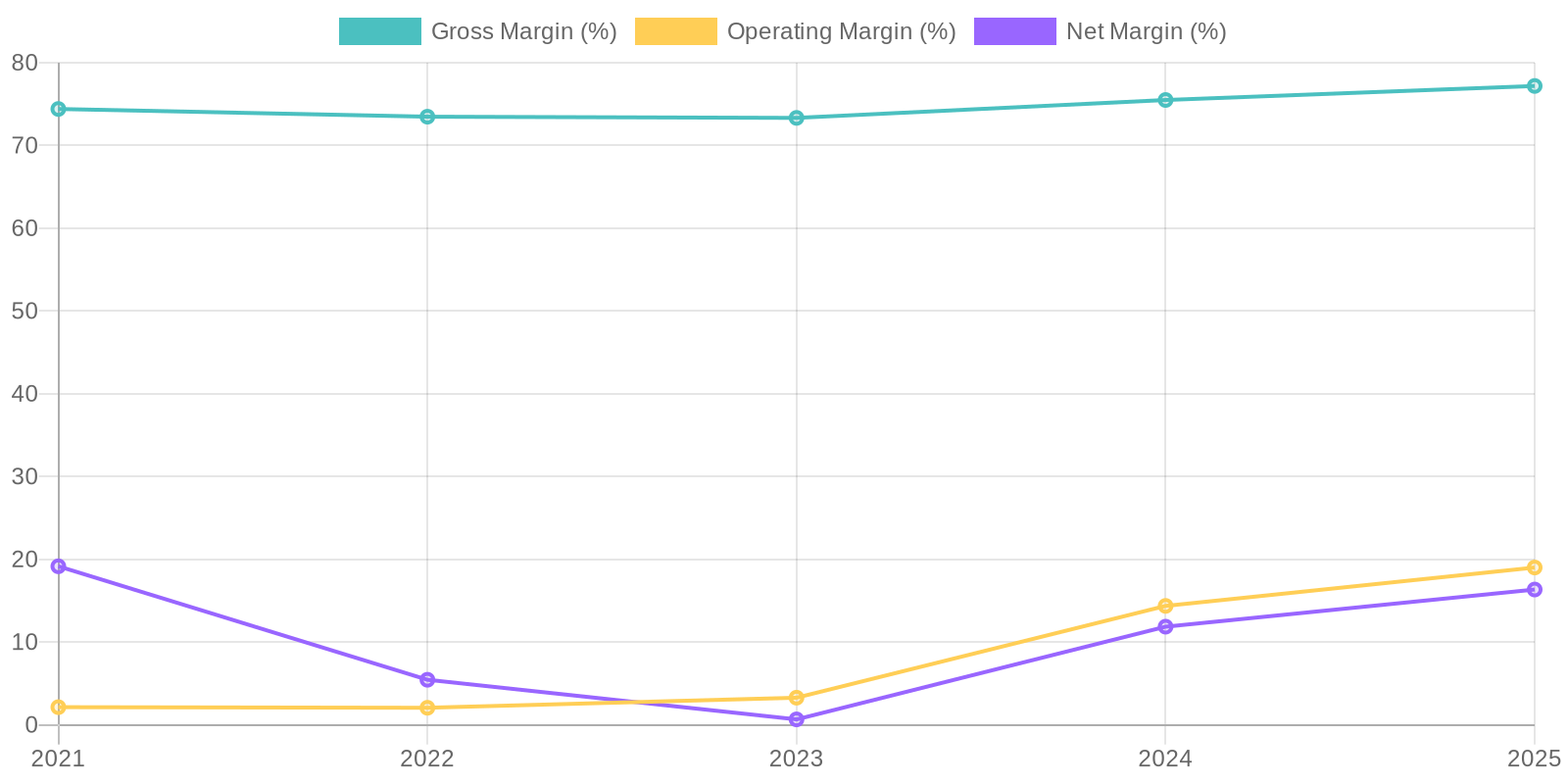

Margin Trend

The company's asset base has grown significantly over the past 5 years, driven by increases in goodwill and intangible assets. Goodwill and intangibles comprise a large portion of total assets, indicating a history of acquisitions. Monitoring the performance of acquired entities is crucial. The company has a relatively high level of deferred revenue, which can skew traditional measures of capital efficiency. Total debt has increased from $6.281B in 2021 to $11.392B in 2025. While the company generates substantial free cash flow, monitoring the debt levels relative to cash flow is important.

The company's asset base has grown significantly over the past 5 years, driven by increases in goodwill and intangible assets. Goodwill and intangibles comprise a large portion of total assets, indicating a history of acquisitions. Monitoring the performance of acquired entities is crucial. The company has a relatively high level of deferred revenue, which can skew traditional measures of capital efficiency. Total debt has increased from $6.281B in 2021 to $11.392B in 2025. While the company generates substantial free cash flow, monitoring the debt levels relative to cash flow is important.

Revenue Quality

High

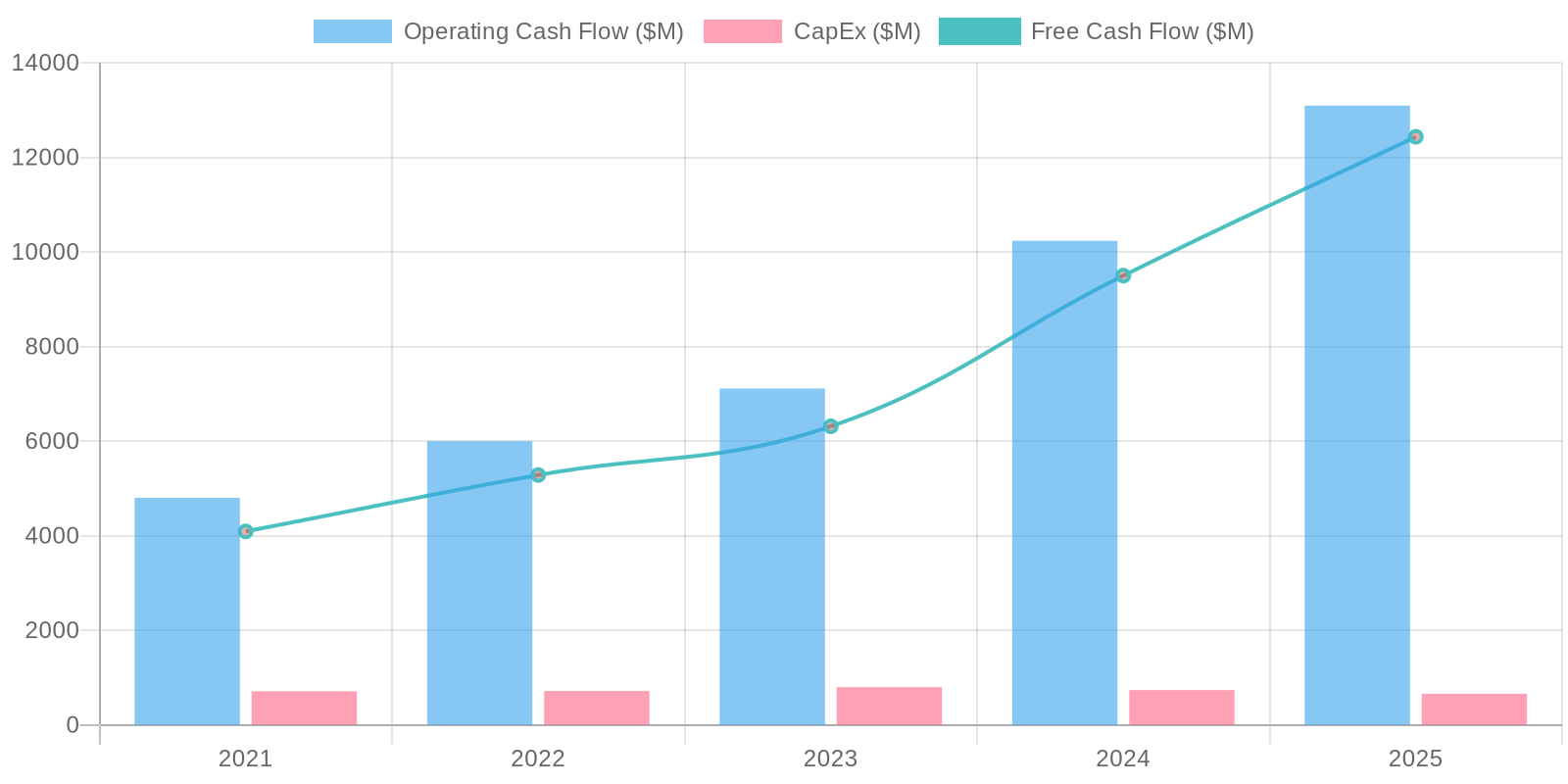

Cash Flow & Capital Efficiency

The company consistently generates positive operating cash flow, with a strong upward trend from $4.801B in 2021 to $13.092B in 2025. Free cash flow is also robust, increasing from $4.091B in 2021 to $12.434B in 2025. The company has been actively repurchasing its own stock. A reconciliation of net income to operating cash flow reveals some non-cash items, such as stock-based compensation and depreciation/amortization. Changes in working capital have a significant impact on operating cash flow.

The company consistently generates positive operating cash flow, with a strong upward trend from $4.801B in 2021 to $13.092B in 2025. Free cash flow is also robust, increasing from $4.091B in 2021 to $12.434B in 2025. The company has been actively repurchasing its own stock. A reconciliation of net income to operating cash flow reveals some non-cash items, such as stock-based compensation and depreciation/amortization. Changes in working capital have a significant impact on operating cash flow.

Capital Efficiency (ROIC/ROE): The company's asset base has grown significantly over the past 5 years, driven by increases in goodwill and intangible assets. Goodwill and intangibles comprise a large portion of total assets, indicating a history of acquisitions. Monitoring the performance of acquired entities is crucial. The company has a relatively high level of deferred revenue, which can skew traditional measures of capital efficiency. Total debt has increased from $6.281B in 2021 to $11.392B in 2025. While the company generates substantial free cash flow, monitoring the debt levels relative to cash flow is important.

Balance Sheet Health: The company's balance sheet shows a healthy cash position, with $8.848B in cash and cash equivalents in 2025. The level of debt has increased to $11.392B. The company's current ratio (Total Current Assets / Total Current Liabilities) is approximately 1.06, indicating sufficient liquidity. Goodwill and intangible assets constitute a significant portion of the company's assets, potentially increasing risk. The company's equity has increased significantly over the past 5 years, reflecting retained earnings and other comprehensive income.

5. Management & Governance

CEO Assessment: Marc Benioff has been a visionary leader, driving Salesforce to become a dominant force in the CRM industry. His focus on innovation and customer success has been instrumental in the company's growth. However, his co-CEO structure with Bret Taylor (until recently) raised some questions about decision-making, though the transition back to a sole CEO seems to be proceeding smoothly. His involvement in philanthropic activities and public advocacy also shapes the company's image and values. Capital Allocation: Good Insider Ownership: Insider ownership is moderate. Marc Benioff holds a significant stake, aligning his interests with shareholders to a considerable extent. Other executives and board members also hold shares, though the overall percentage of insider ownership is not exceptionally high compared to other tech companies. Regular monitoring of insider trading activity is warranted to ensure continued alignment.

Governance Flags: Dual-class share structure could concentrate voting power in the hands of insiders, potentially limiting the influence of other shareholders., High executive compensation relative to performance could be a concern if not properly aligned with long-term shareholder value creation., Related-party transactions, if any, should be carefully reviewed to ensure fairness and transparency.

6. Valuation

Method: Discounted Cash Flow (DCF) Fair Value: 267.5

I have projected the free cash flows for the next 5 years using a decreasing revenue growth rate, starting at 10% and tapering to 5%. I used a terminal growth rate of 3% and a discount rate of 8% to calculate the present value of future cash flows. I've also considered the net debt and shares outstanding to arrive at an estimated per-share value. A P/S ratio check is generally in line with peers, but DCF is used as primary driver due to available data. The upside is around 14.6% higher than the current price. Bear case is slightly negative, around 10% due to market risk.

Scenarios

| Scenario | Price Target | Key Assumptions |

|---|---|---|

| Bull | High | - Accelerated revenue growth exceeding 15% annually. |

- Significant operating margin expansion driven by synergies and cost controls.

- Dominant market share in the CRM space maintained and expanded.

- Successful innovation and introduction of new product offerings. | | Base | 267.5 | - Sustained revenue growth of 10-12% annually.

- Moderate margin expansion through operational improvements.

- Continued leadership in the CRM market with steady market share.

- Integration of acquisitions proceeds as planned.

- Consistent Free Cash Flow generation. | | Bear | Low | - Slowdown in cloud CRM adoption due to economic headwinds.

- Unsuccessful integration of acquisitions leading to lost synergies.

- Increased competition from other CRM providers (e.g., Microsoft, Oracle).

- Inability to maintain pricing power, impacting margins.

- Decline in FCF generation. |

7. Risks

Salesforce exhibits a moderate risk profile. While revenue growth and free cash flow are positive, high debt, substantial goodwill/intangibles, and reliance on stock-based compensation create vulnerabilities. Potential market saturation and integration risks from acquisitions also contribute to this assessment.

Red Flags:

- High levels of goodwill and intangible assets

- Increase in debt.

- Reliance on stock-based compensation.

8. Conclusion

Salesforce will maintain its leadership position in the CRM market, delivering consistent revenue growth and moderate margin expansion. The integration of acquired businesses will contribute to overall growth, and the company's strong free cash flow generation will support shareholder returns. Their Customer 360 platform will continue to be integral to customer success.

Generated by Jules Deep Dive Engine. Not financial advice.