Ciena Corporation (CIEN)

Executive Summary

Ciena could achieve significant growth if it can capitalize on the increasing demand for bandwidth and network infrastructure upgrades. Successful product launches and market expansion could drive revenue and earnings growth, leading to a higher stock price.

Investment Thesis

The Bull Case

Ciena could achieve significant growth if it can capitalize on the increasing demand for bandwidth and network infrastructure upgrades. Successful product launches and market expansion could drive revenue and earnings growth, leading to a higher stock price.

Catalysts:

- Increased demand for bandwidth and network infrastructure upgrades.

- Successful development and launch of new products and services.

- Expansion into new markets and customer segments.

The Bear Case (Risks)

If Ciena fails to adapt to technological changes, experiences significant supply chain disruptions, or loses key customers, the company's revenue and profitability could decline significantly. This could lead to a decline in the stock price.

Risks:

- Intense Competition

- Supply Chain Disruptions

- Customer Concentration

📊 The Numbers

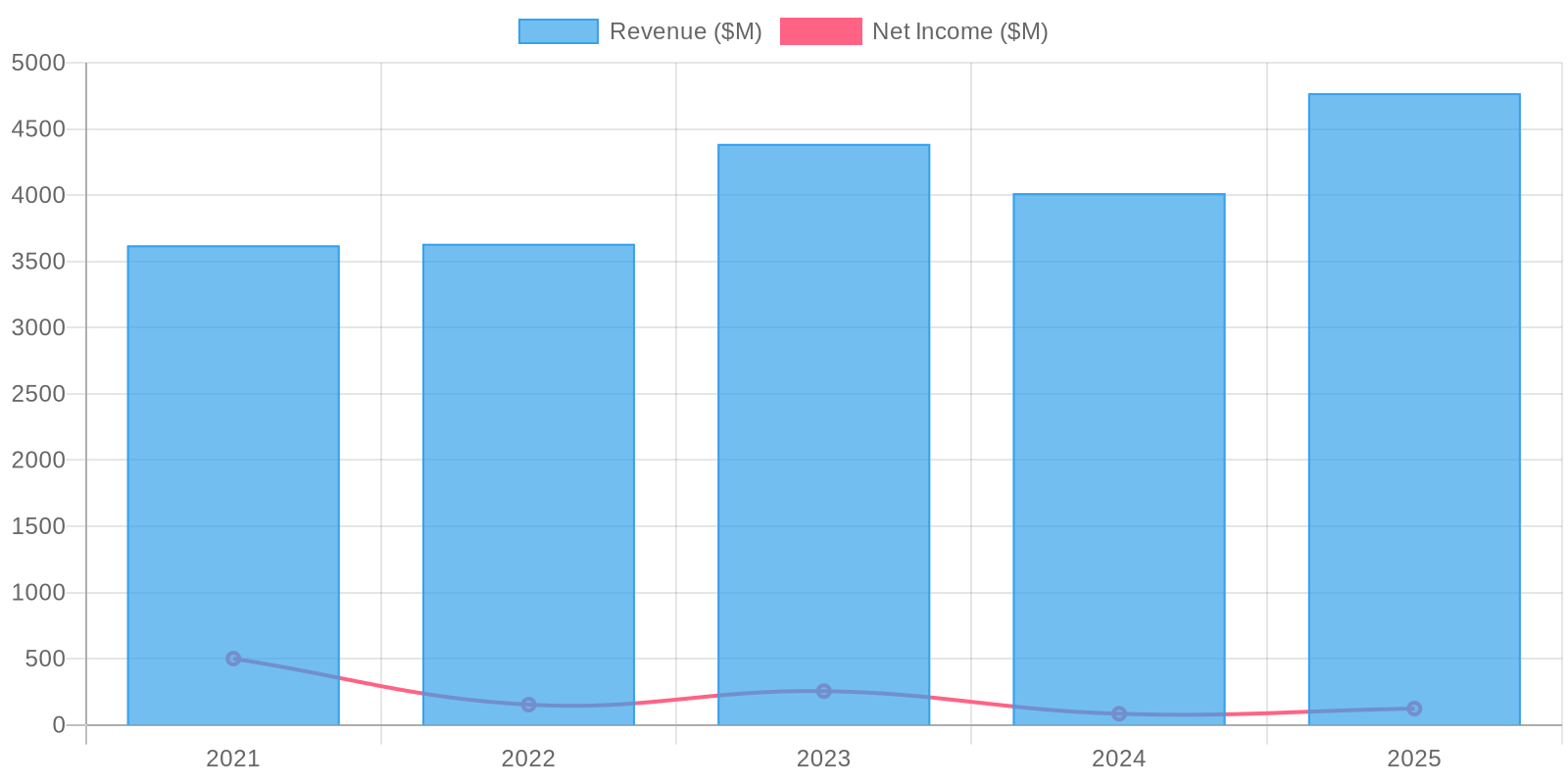

Revenue & Growth

Revenue has grown at a CAGR of 0.3% over the last period.