Celestica Inc. (CLS)

Executive Summary

If Celestica can successfully capitalize on growth opportunities, improve its operational efficiency, and execute strategic initiatives, its stock price could appreciate significantly.

Investment Thesis

The Bull Case

If Celestica can successfully capitalize on growth opportunities, improve its operational efficiency, and execute strategic initiatives, its stock price could appreciate significantly.

Catalysts:

- Continued expansion in key growth sectors (aerospace, healthtech, cloud).

- Further improvements in operational efficiency and profitability.

- Strategic acquisitions or partnerships that expand Celestica's capabilities or market reach.

The Bear Case (Risks)

If Celestica fails to manage its supply chain effectively, adapt to technological changes, or retain key customers, its financial performance could deteriorate significantly, leading to a substantial decline in its stock price.

Risks:

- Supply chain disruptions

- Technological obsolescence

- Loss of key customers

📊 The Numbers

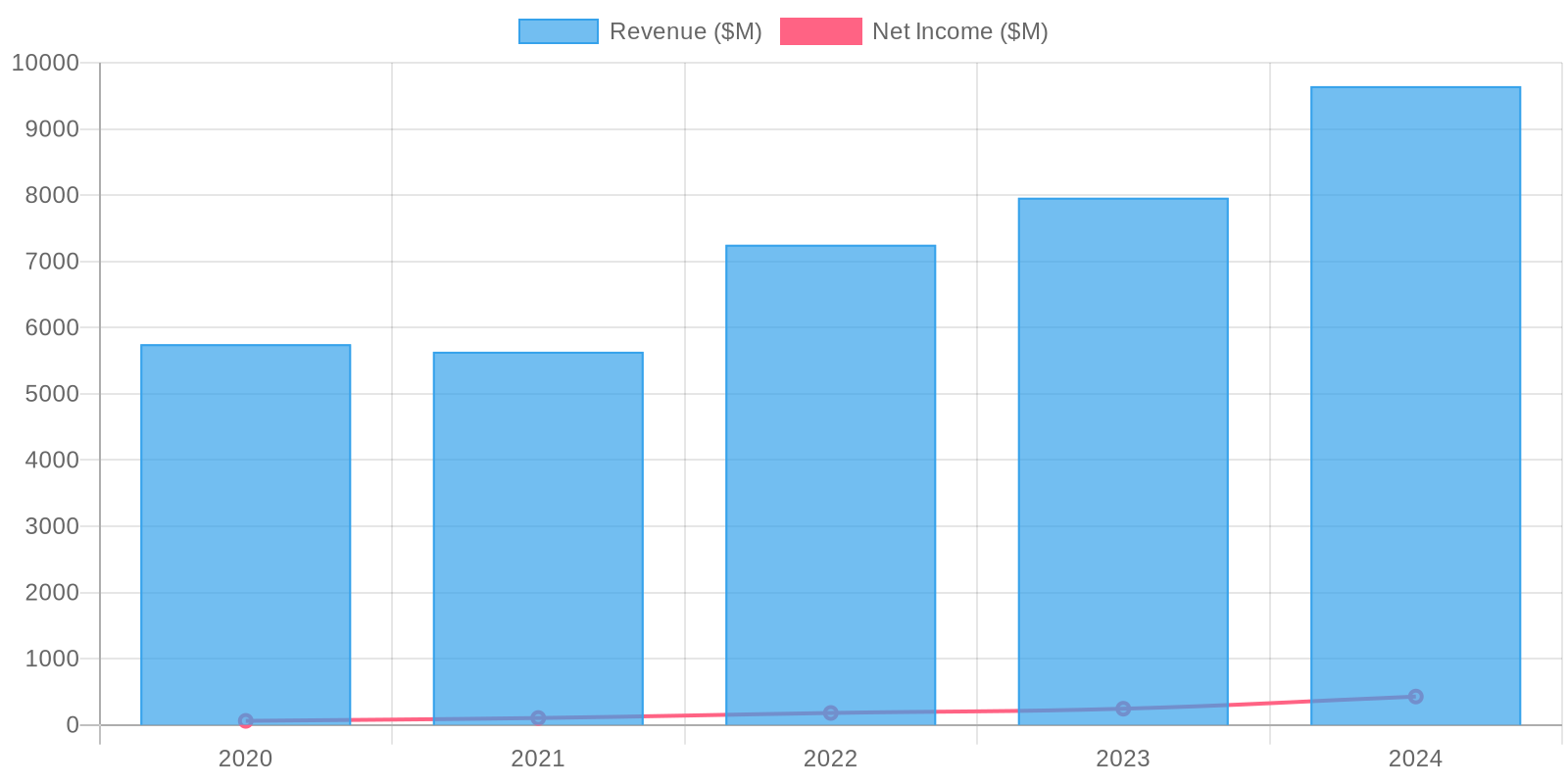

Revenue & Growth

Revenue has grown at a CAGR of 0.7% over the last period.

Valuation

$270 (Upside: 0%) Discounted Cash Flow (DCF)