CoreWeave, Inc. Class A Common Stock (CRWV)

Executive Summary

CoreWeave's position in the rapidly expanding GenAI infrastructure market offers substantial upside potential. Successful execution of its growth strategy, coupled with increasing adoption of GPU-accelerated computing, could lead to significant returns for investors.

Investment Thesis

The Bull Case

CoreWeave's position in the rapidly expanding GenAI infrastructure market offers substantial upside potential. Successful execution of its growth strategy, coupled with increasing adoption of GPU-accelerated computing, could lead to significant returns for investors.

Catalysts:

- Continued rapid growth in the GenAI market.

- Successful expansion of service offerings.

- Strategic partnerships with major AI players.

The Bear Case (Risks)

CoreWeave's high debt and negative profitability present significant downside risk. Increased competition and potential economic downturns could further exacerbate these challenges, leading to substantial losses for investors.

Risks:

- Inability to manage debt burden.

- Failure to achieve profitability.

- Loss of market share to larger competitors.

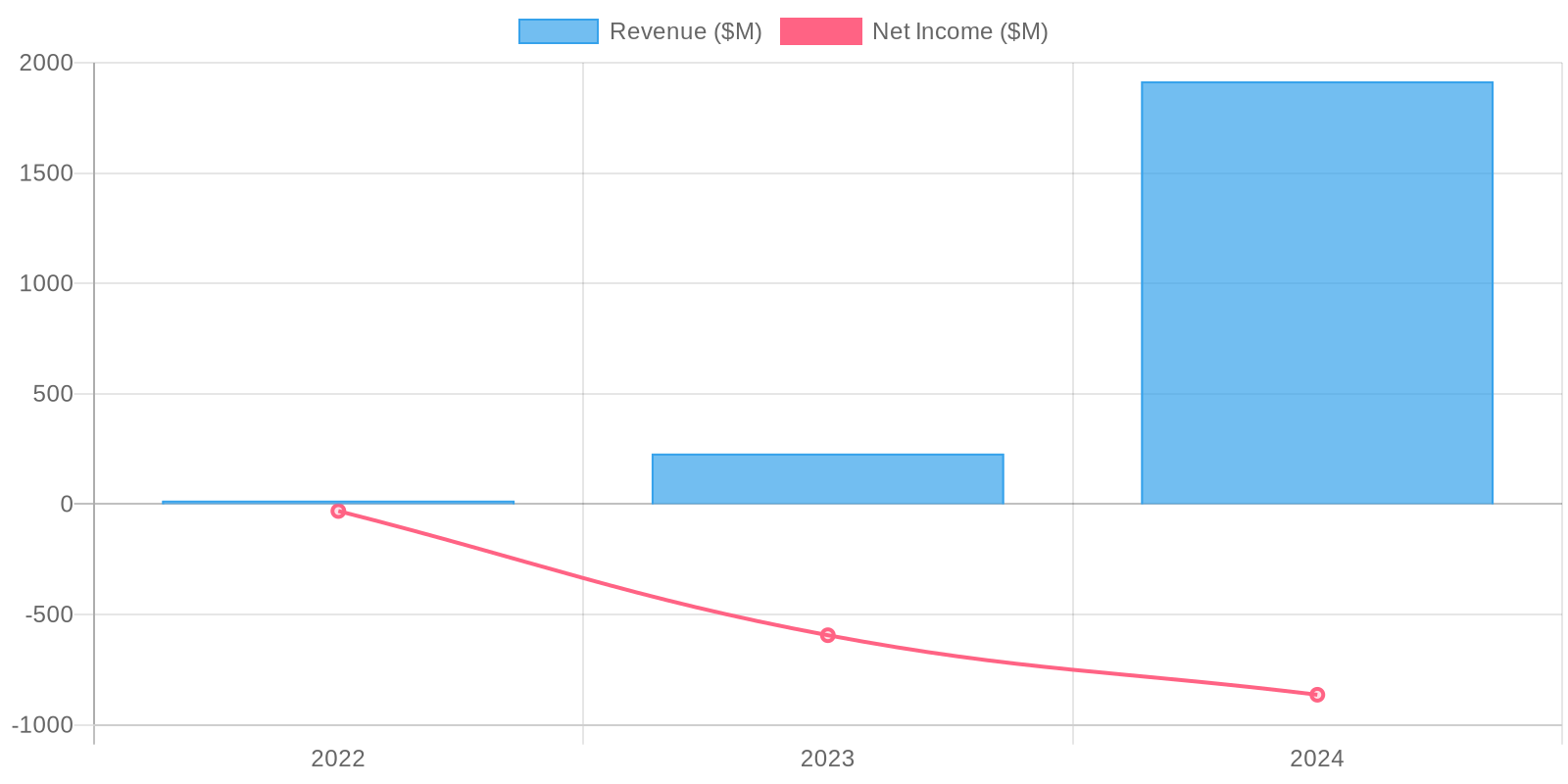

📊 The Numbers

Revenue & Growth

Revenue has grown at a CAGR of 120.0% over the last period.