Cognizant Technology Solutions Corporation (CTSH)

Executive Summary

Cognizant could significantly outperform expectations if it capitalizes on the growing demand for digital transformation services, successfully integrates strategic acquisitions, and achieves substantial margin improvements.

Investment Thesis

The Bull Case

Cognizant could significantly outperform expectations if it capitalizes on the growing demand for digital transformation services, successfully integrates strategic acquisitions, and achieves substantial margin improvements.

Catalysts:

- Faster-than-expected growth in digital transformation spending.

- Successful acquisitions that expand Cognizant's capabilities and market reach.

- Improved profitability through cost optimization and higher-value services.

The Bear Case (Risks)

If Cognizant fails to effectively compete in the rapidly evolving IT services market or experiences a significant economic downturn, its revenue and profitability could decline substantially.

Risks:

- Competition

- Global Economic Conditions

- Data Security and Privacy

📊 The Numbers

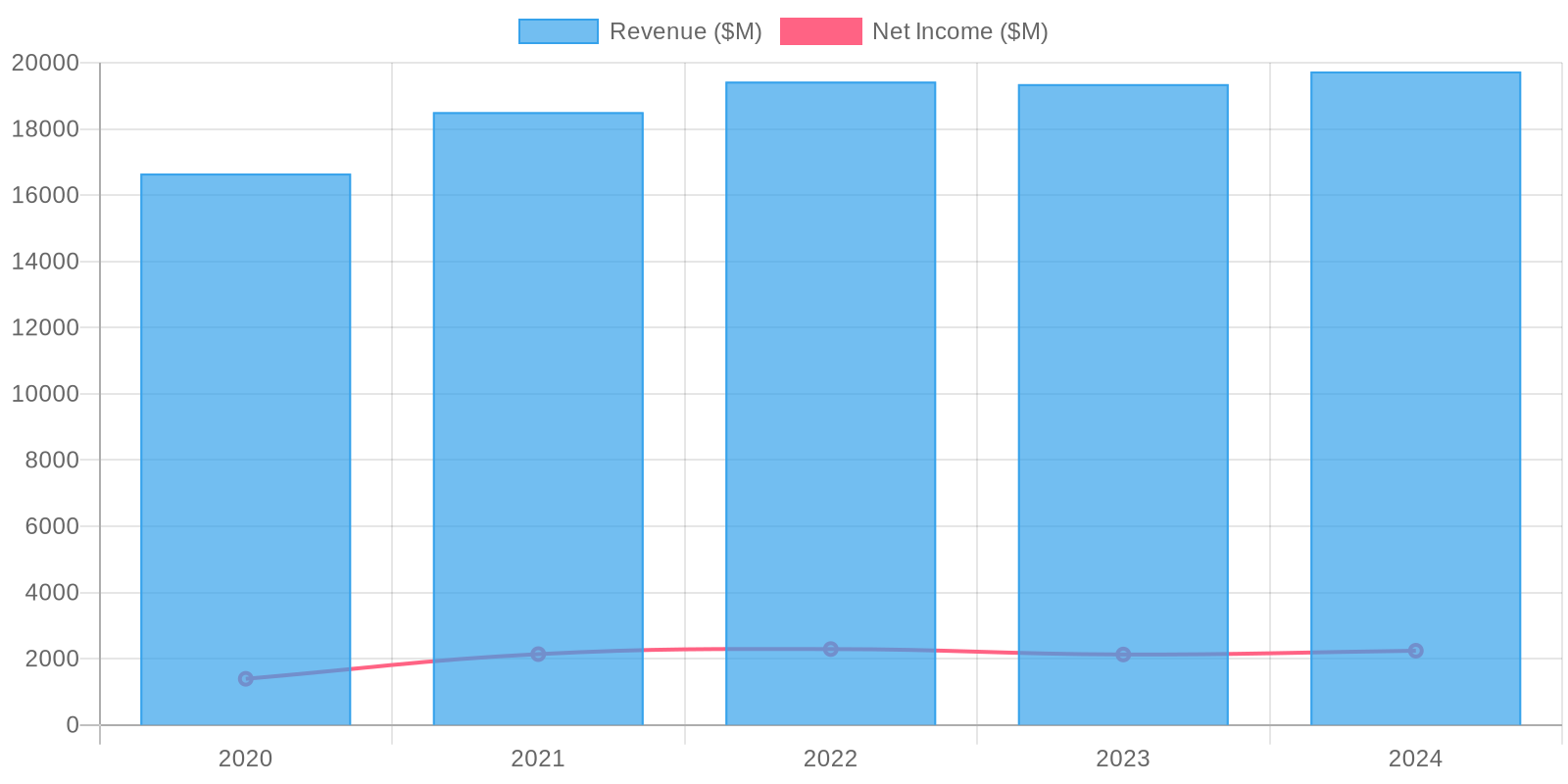

Revenue & Growth

Revenue has grown at a CAGR of 0.2% over the last period.

Valuation

$75.15 (Upside: 0%) Discounted Cash Flow (DCF)