Garmin Ltd. (GRMN)

Executive Summary

Garmin could experience significant growth if it successfully launches new products, makes strategic acquisitions, and capitalizes on increasing consumer interest in its core segments.

Investment Thesis

The Bull Case

Garmin could experience significant growth if it successfully launches new products, makes strategic acquisitions, and capitalizes on increasing consumer interest in its core segments.

Catalysts:

- Successful introduction of new products in high-growth segments like aviation and marine.

- Strategic acquisitions to expand market presence and technological capabilities.

- Stronger-than-expected growth in the fitness and outdoor segments due to increased consumer interest in health and wellness.

The Bear Case (Risks)

A significant downturn could occur if Garmin fails to innovate quickly enough to maintain its competitive edge or if supply chain issues arise due to its reliance on TSMC, or if the EU antitrust case results in penalties.

Risks:

- Intensified competition

- Supply chain disruptions

- Regulatory headwinds

📊 The Numbers

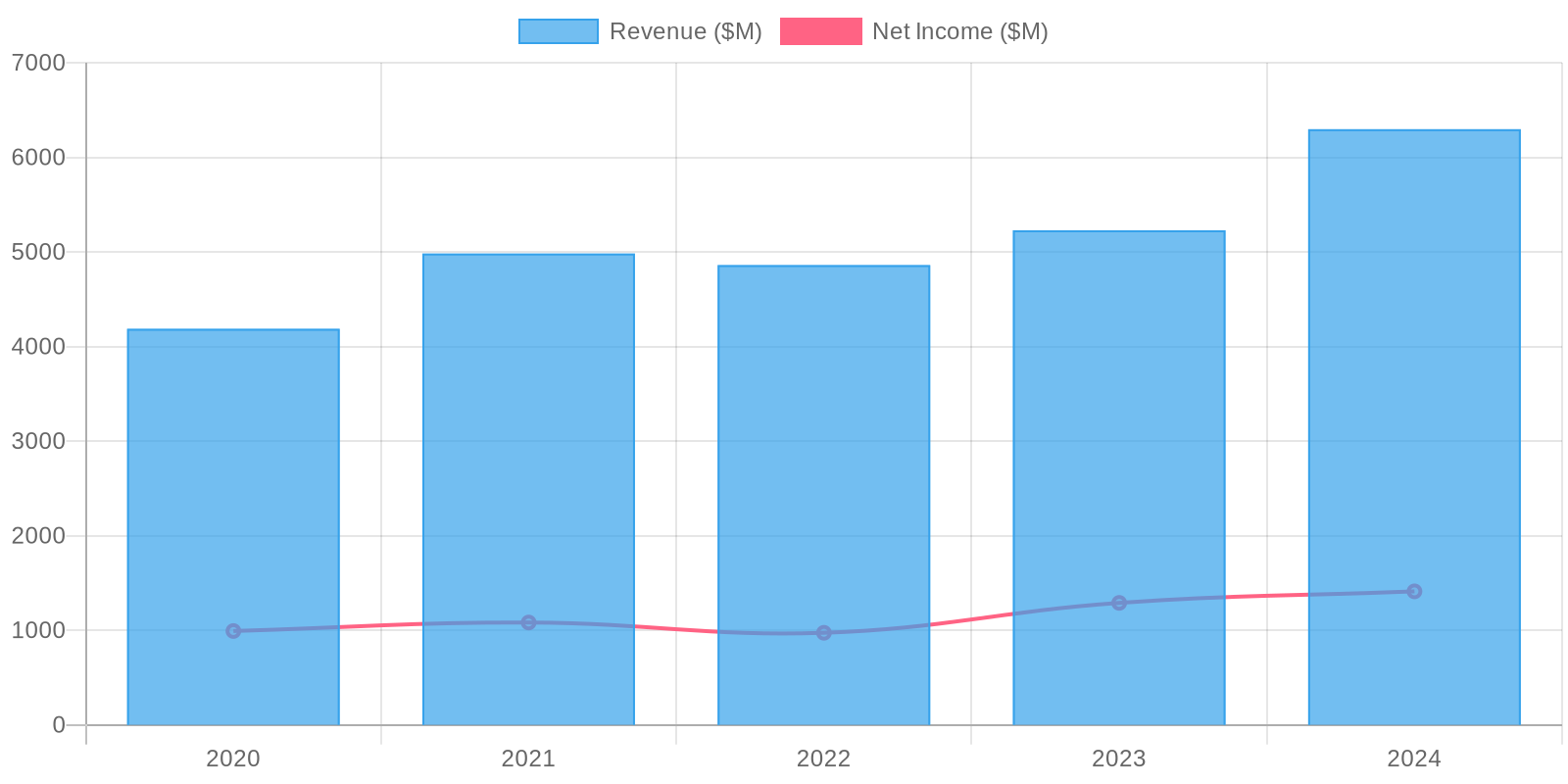

Revenue & Growth

Revenue has grown at a CAGR of 0.5% over the last period.

Valuation

$235 (Upside: 0.15%) Discounted Cash Flow (DCF)