Keysight Technologies, Inc. (KEYS)

Executive Summary

Strong growth in key markets combined with successful execution of strategic initiatives could drive significant upside for Keysight.

Investment Thesis

The Bull Case

Strong growth in key markets combined with successful execution of strategic initiatives could drive significant upside for Keysight.

Catalysts:

- Faster than expected growth in key markets.

- Successful integration of Spirent Communications.

- Breakthrough innovations driving new product adoption.

The Bear Case (Risks)

Downside risks exist from supply chain concentration, regulatory pressures, and integration of Spirent. Materialization of these risks could negatively impact performance.

Risks:

- Supply chain disruptions

- Regulatory headwinds

- Integration challenges

📊 The Numbers

Revenue & Growth

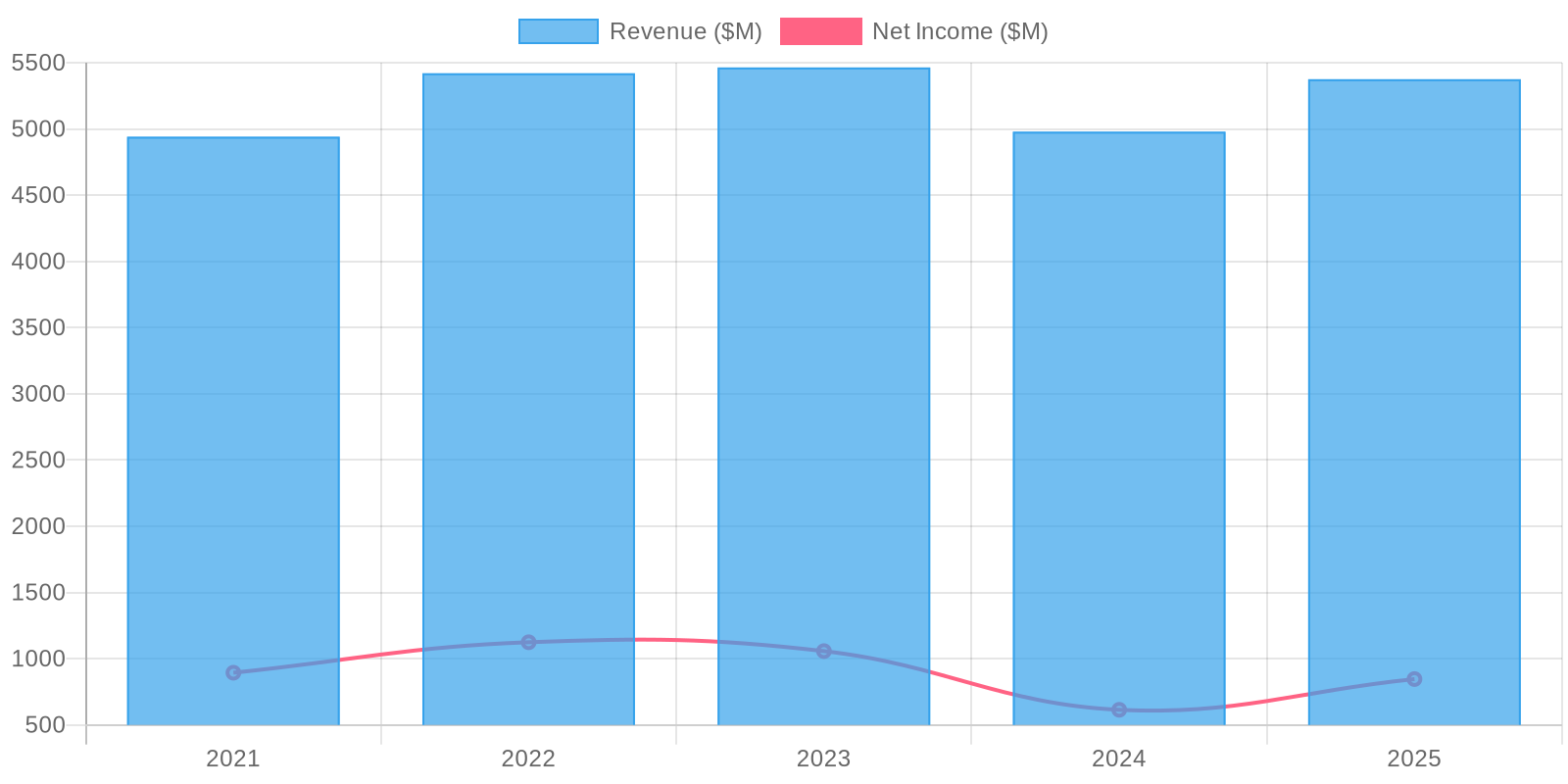

Revenue has grown at a CAGR of 0.1% over the last period.

Valuation

Fair Value Estimate: $195 (Upside: 0%) Methodology: Discounted Cash Flow (DCF)