Lumentum Holdings Inc. (LITE)

Executive Summary

Upside potential exists if Lumentum can capitalize on growth opportunities and manage its debt effectively.

Investment Thesis

The Bull Case

Upside potential exists if Lumentum can capitalize on growth opportunities and manage its debt effectively.

Catalysts:

- Stronger-than-expected growth in 5G infrastructure and data center spending.

- Successful development and commercialization of new laser technologies.

- Strategic acquisitions that enhance market position and diversification.

The Bear Case (Risks)

Downside risks are significant due to debt load and customer concentration.

Risks:

- Customer concentration presents vulnerability.

- Acquisition integration challenges may hinder synergies.

- Convertible debt could dilute shareholder value.

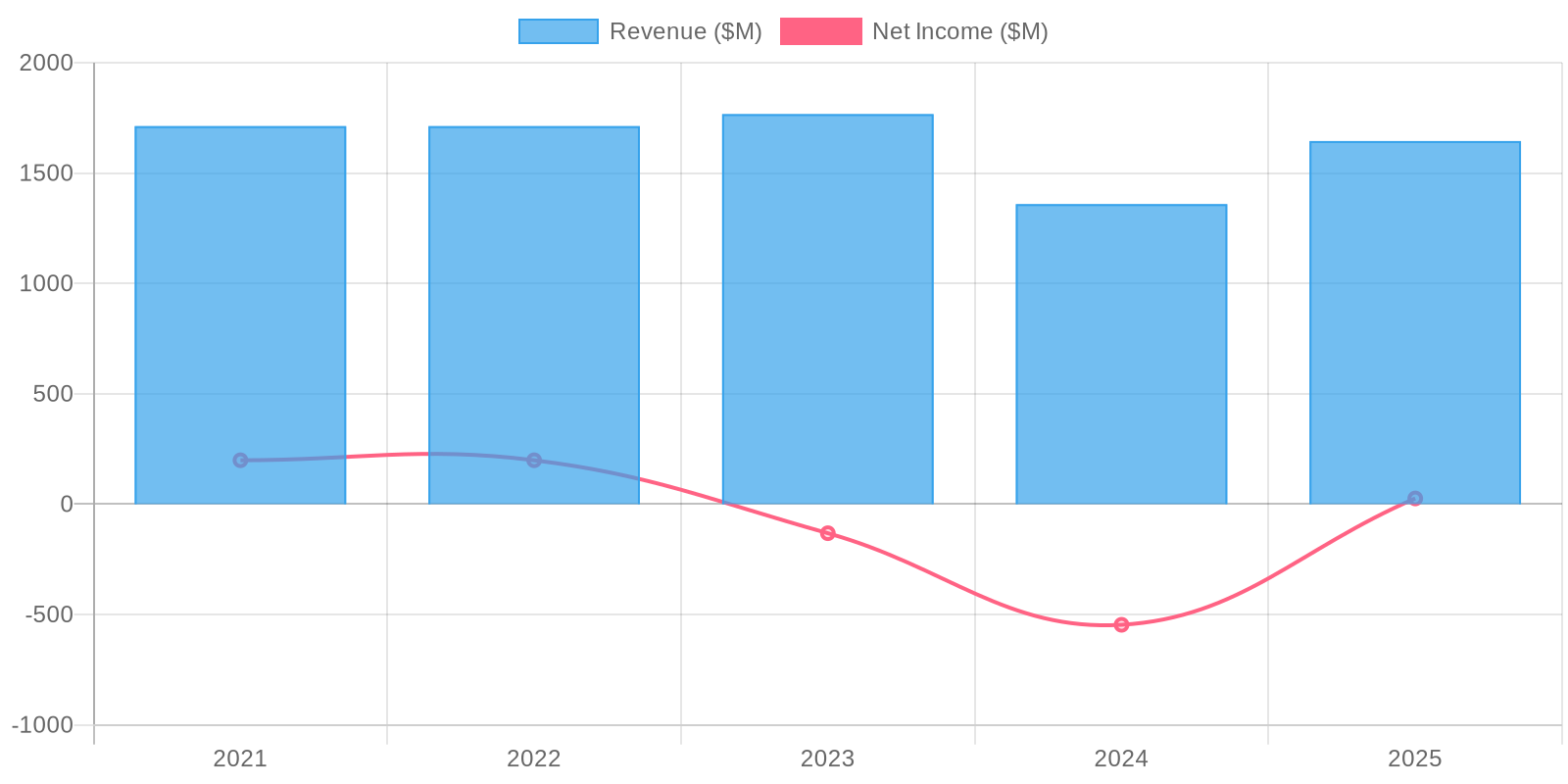

📊 The Numbers

Revenue & Growth

Revenue has grown at a CAGR of -0.0% over the last period.

Valuation

Fair Value Estimate: $300 (Upside: 0.05%) Methodology: Price to Sales