Microchip Technology Incorporated (MCHP)

Executive Summary

A bull case hinges on Microchip's ability to innovate and gain market share in key segments while managing its debt effectively.

Investment Thesis

The Bull Case

A bull case hinges on Microchip's ability to innovate and gain market share in key segments while managing its debt effectively.

Catalysts:

- Stronger-than-expected demand for embedded control solutions.

- Successful development and launch of new products.

- Improved operational efficiency and cost management.

The Bear Case (Risks)

A bear case would materialize if Microchip fails to address its debt load, navigate regulatory hurdles, and maintain its market share.

Risks:

- Deterioration of macroeconomic conditions.

- Increased competition in the semiconductor industry.

- Execution risks associated with integrating acquisitions.

📊 The Numbers

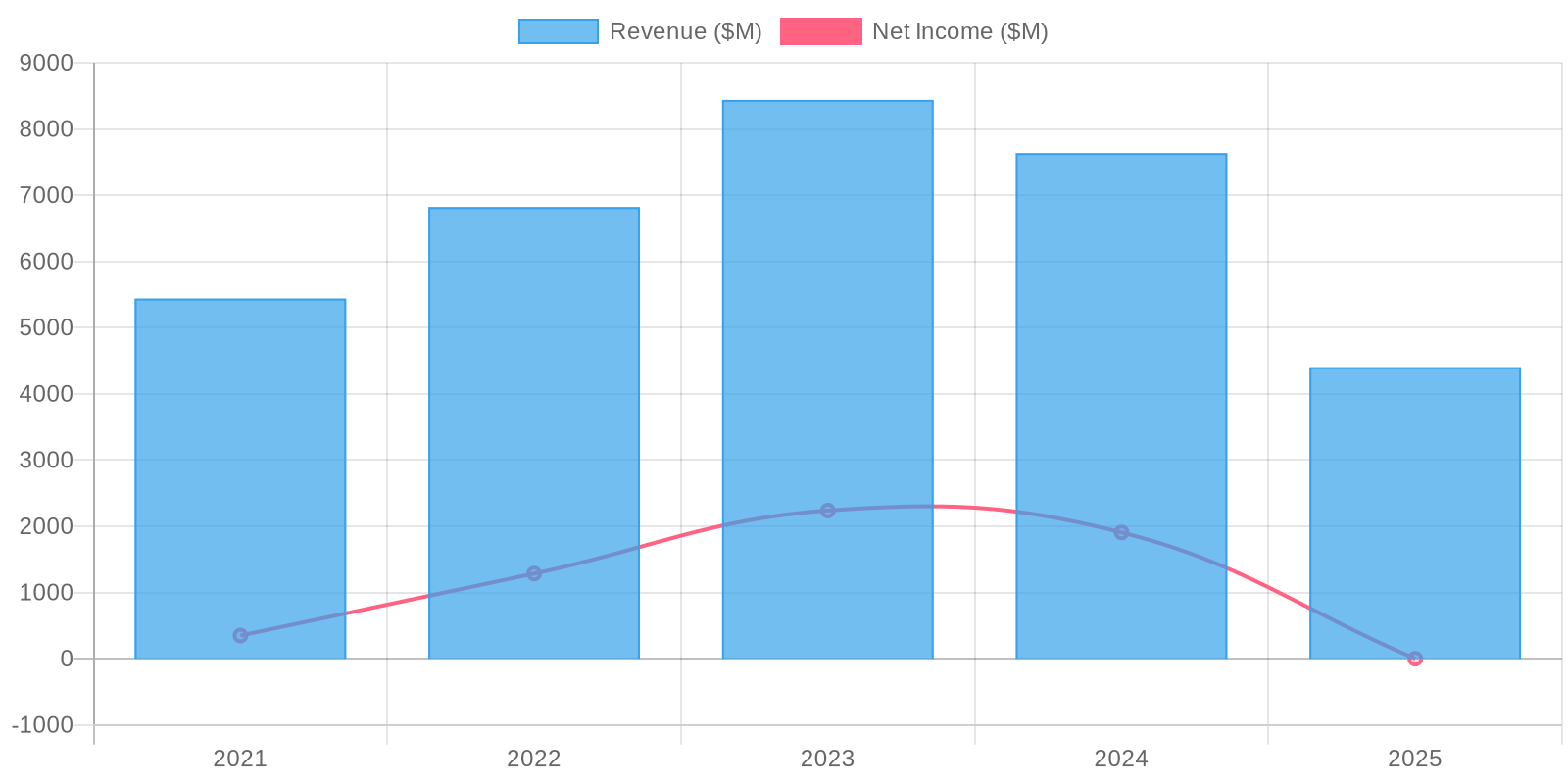

Revenue & Growth

Revenue has grown at a CAGR of -0.2% over the last period.

Valuation

Fair Value Estimate: $54.77 (Upside: 0%) Methodology: Price-to-Sales Ratio