NXP Semiconductors N.V. (NXPI)

Executive Summary

NXP could significantly outperform if it capitalizes on favorable trends in its key markets and executes its growth strategy effectively.

Investment Thesis

The Bull Case

NXP could significantly outperform if it capitalizes on favorable trends in its key markets and executes its growth strategy effectively.

Catalysts:

- Faster-than-expected growth in automotive semiconductors.

- Successful integration of future acquisitions.

- Significant innovation in new product categories.

The Bear Case (Risks)

A significant economic downturn or unexpected competitive pressure could negatively impact NXP's financial performance and stock price.

Risks:

- Cyclicality of the semiconductor industry.

- Dependence on key customers.

- Exposure to geopolitical risks.

📊 The Numbers

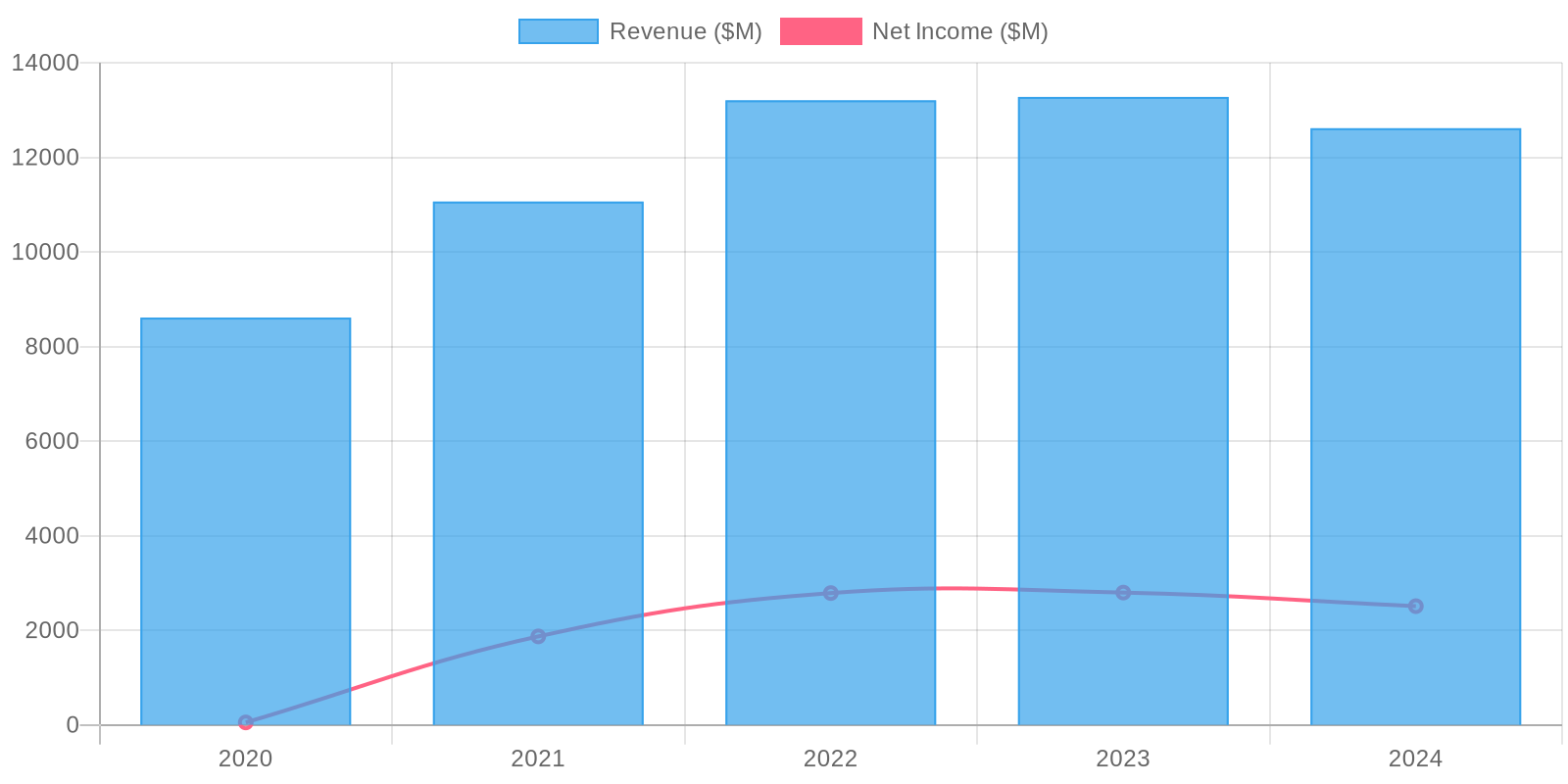

Revenue & Growth

Revenue has grown at a CAGR of 0.5% over the last period.

Valuation

Fair Value Estimate: $208.15 (Upside: 0.026%) Methodology: Price/Sales