Rockwell Automation, Inc. (ROK)

Executive Summary

Rockwell Automation will capitalize on the increasing demand for automation and digital transformation, exceeding market expectations through innovative solutions and strategic partnerships, resulting in significant revenue and profit growth.

Investment Thesis

The Bull Case

Rockwell Automation will capitalize on the increasing demand for automation and digital transformation, exceeding market expectations through innovative solutions and strategic partnerships, resulting in significant revenue and profit growth.

Catalysts:

- Stronger-than-expected growth in automation spending across key industries.

- Successful development and adoption of new digital transformation solutions.

- Strategic acquisitions that expand market reach and product offerings.

- Significant improvement in supply chain resilience.

The Bear Case (Risks)

A significant economic downturn, coupled with increased competitive pressures and supply chain vulnerabilities, could negatively impact Rockwell Automation's revenue and profitability.

Risks:

- Competition

- Supply Chain Disruptions

- Regulatory Scrutiny

- Economic Slowdown

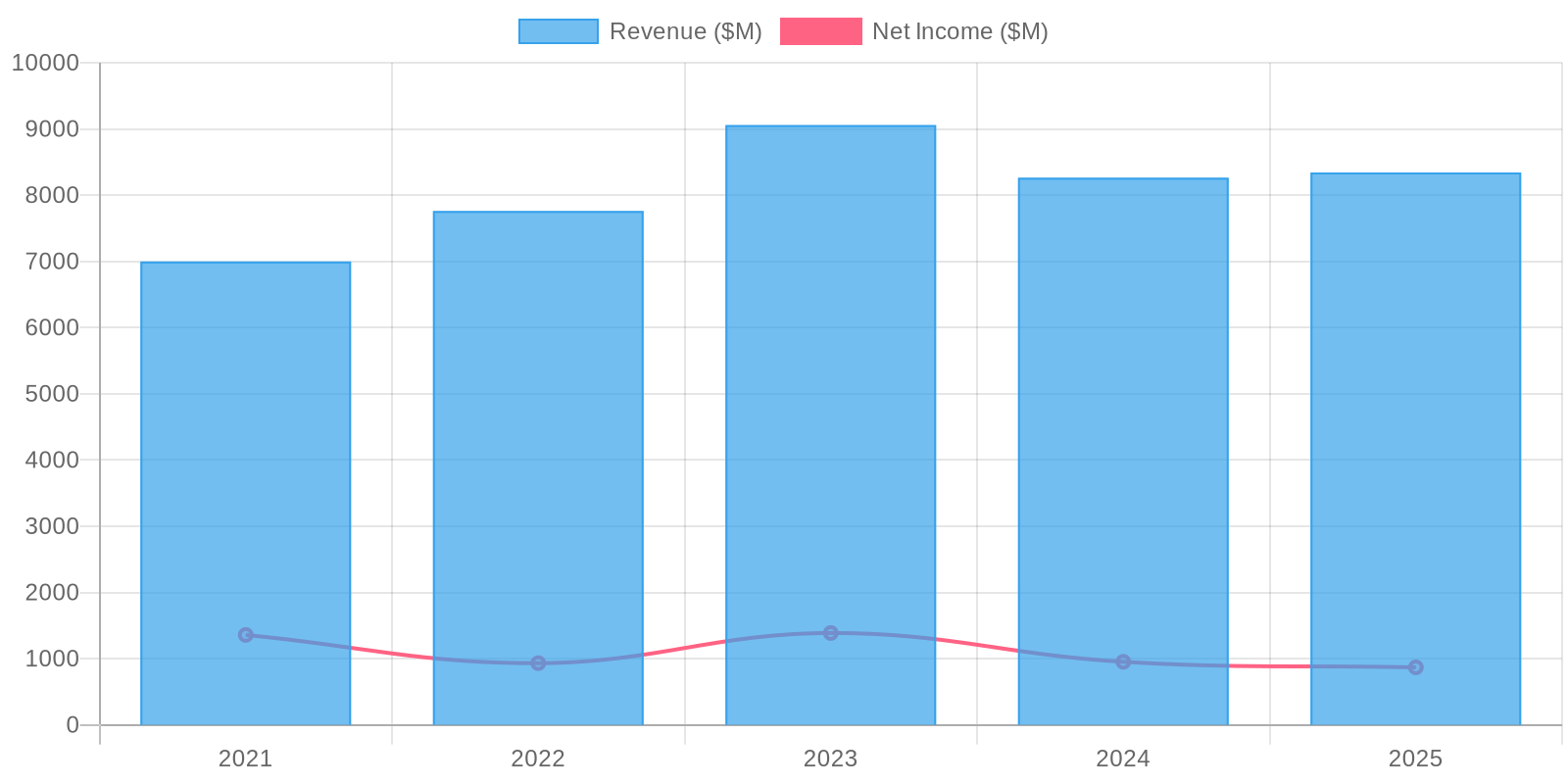

📊 The Numbers

Revenue & Growth

Revenue has grown at a CAGR of 0.2% over the last period.