Roper Technologies, Inc. (ROP)

Executive Summary

Roper is positioned to benefit from the increasing demand for niche software and engineered products. Successful execution of its growth strategy and capital allocation plan could drive significant shareholder value.

Investment Thesis

The Bull Case

Roper is positioned to benefit from the increasing demand for niche software and engineered products. Successful execution of its growth strategy and capital allocation plan could drive significant shareholder value.

Catalysts:

- Successful integration of recent acquisitions.

- Continued growth in recurring revenue streams.

- Expansion into new markets and verticals.

- Acceleration of digital transformation initiatives.

- Strategic divestitures of non-core assets.

The Bear Case (Risks)

If Roper fails to successfully integrate future acquisitions, encounters significant supply chain disruptions, or faces increased regulatory scrutiny, its growth and profitability could be negatively impacted.

Risks:

- Integration Risk

- Supply Chain Dependency

- Regulatory Pressure

- High Debt

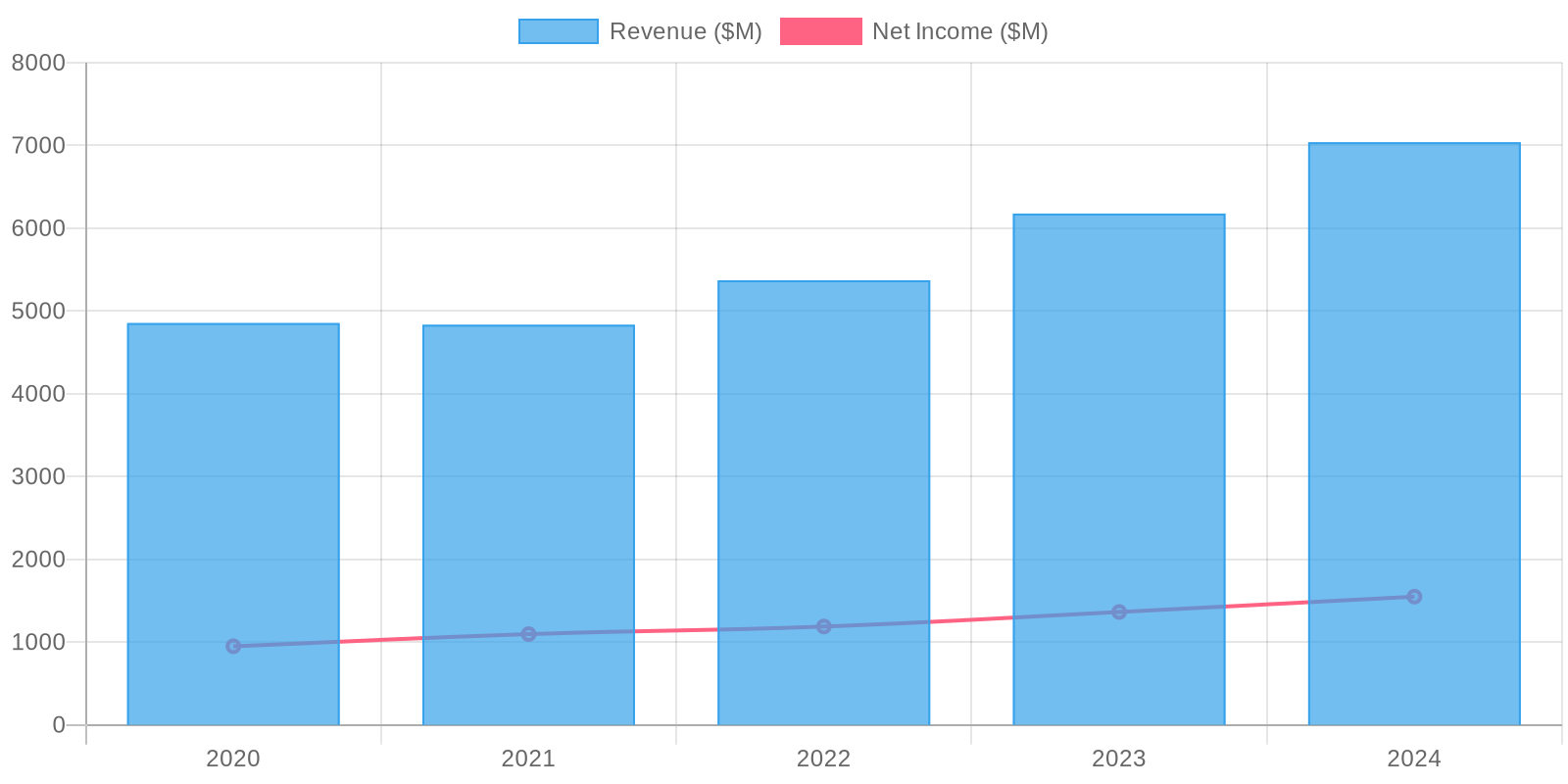

📊 The Numbers

Revenue & Growth

Revenue has grown at a CAGR of 0.5% over the last period.