TE Connectivity Ltd. (TEL)

Executive Summary

TE Connectivity is well-positioned to benefit from secular growth trends in electric vehicles, industrial automation, and IoT. Successful execution of their growth strategy could lead to significant shareholder value creation.

Investment Thesis

The Bull Case

TE Connectivity is well-positioned to benefit from secular growth trends in electric vehicles, industrial automation, and IoT. Successful execution of their growth strategy could lead to significant shareholder value creation.

Catalysts:

- Increased adoption of electric vehicles and autonomous driving technologies.

- Growth in industrial automation and IoT.

- Expansion into new markets and applications.

- Successful integration of acquisitions.

- Stronger than expected revenue growth.

The Bear Case (Risks)

A significant economic downturn or unforeseen operational challenges could negatively impact TE Connectivity's financial performance.

Risks:

- Economic recession impacting key industries.

- Supply chain disruptions.

- Increased competition.

- Regulatory challenges.

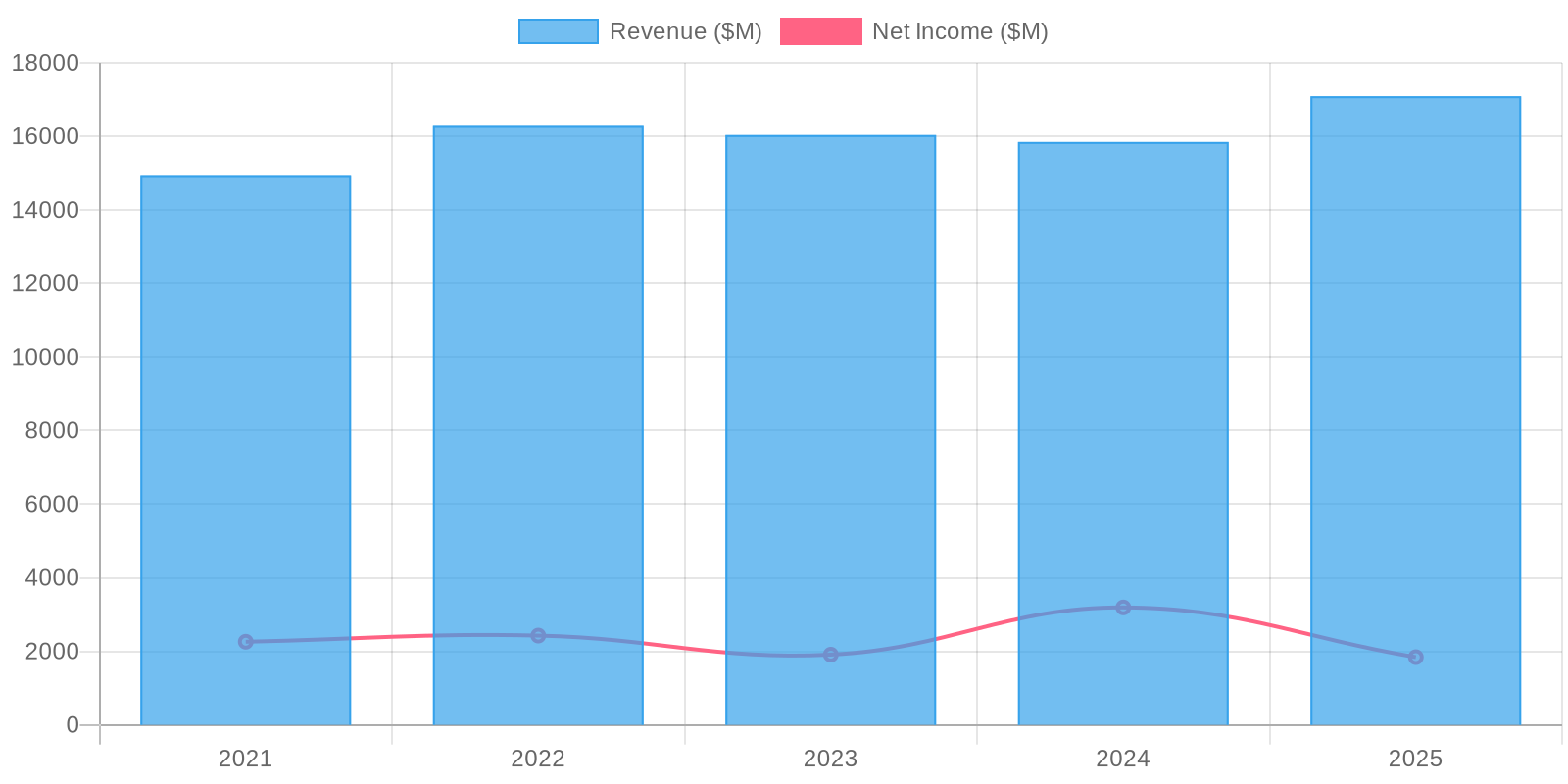

📊 The Numbers

Revenue & Growth

Revenue has grown at a CAGR of 0.1% over the last period.