Vertiv Holdings Co (VRT)

Executive Summary

If Vertiv successfully executes on its growth strategy and benefits from favorable industry trends, the company could generate significantly higher returns.

Investment Thesis

The Bull Case

If Vertiv successfully executes on its growth strategy and benefits from favorable industry trends, the company could generate significantly higher returns.

Catalysts:

- Faster than expected growth in data center spending.

- Successful introduction of new products and services.

- Accretive acquisitions that expand Vertiv's market reach.

- Significant improvements in supply chain efficiency.

The Bear Case (Risks)

Risks not explicitly detailed in structured output.

Risks:

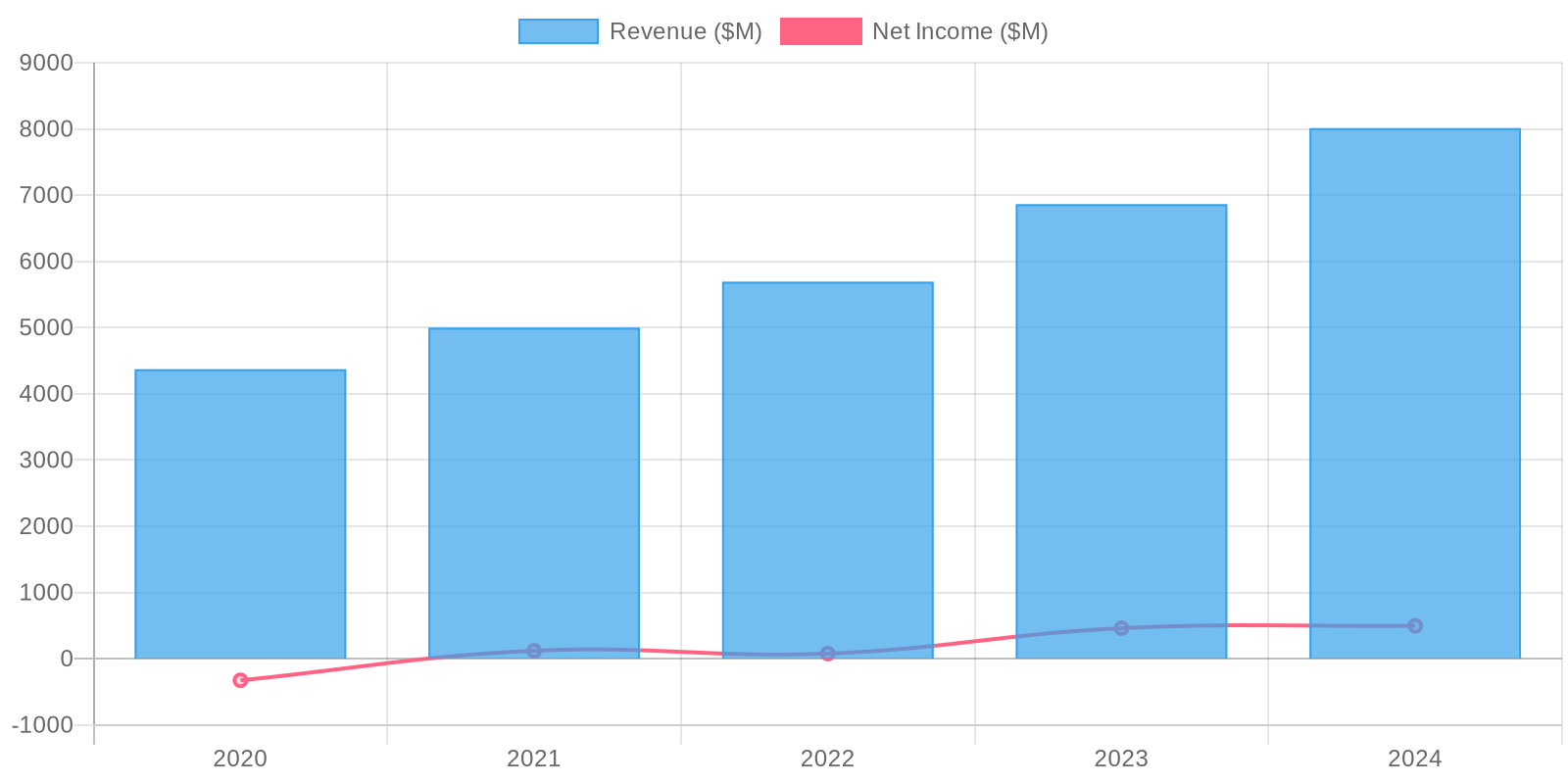

📊 The Numbers

Revenue & Growth

Revenue has grown at a CAGR of 0.8% over the last period.

Valuation

Fair Value Estimate: $180 (Upside: 0.1%) Methodology: Discounted Cash Flow (DCF)

Analyst Thinking: Vertiv's current market price does not fully reflect its growth prospects and operational improvements. A DCF analysis provides a more accurate valuation by considering the company's future cash flows.